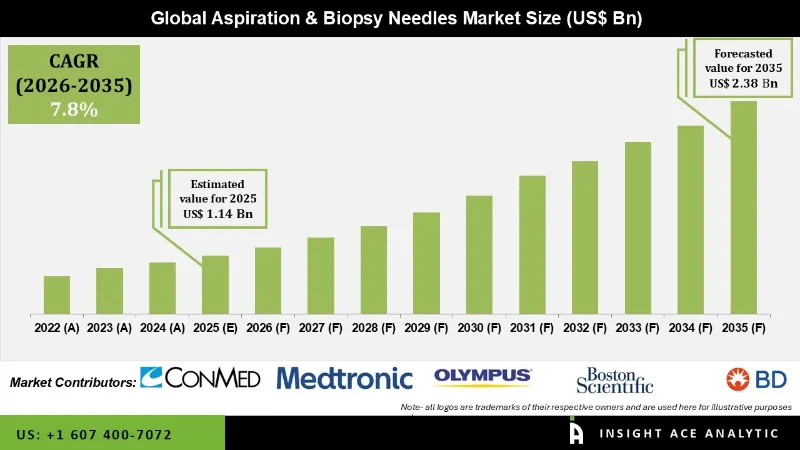

Aspiration & Biopsy Needles Market Size is valued at USD 1.14 Bn in 2025 and is predicted to reach USD 2.28 Bn by the year 2035 at a 7.8% CAGR during the forecast period for 2026 to 2035.

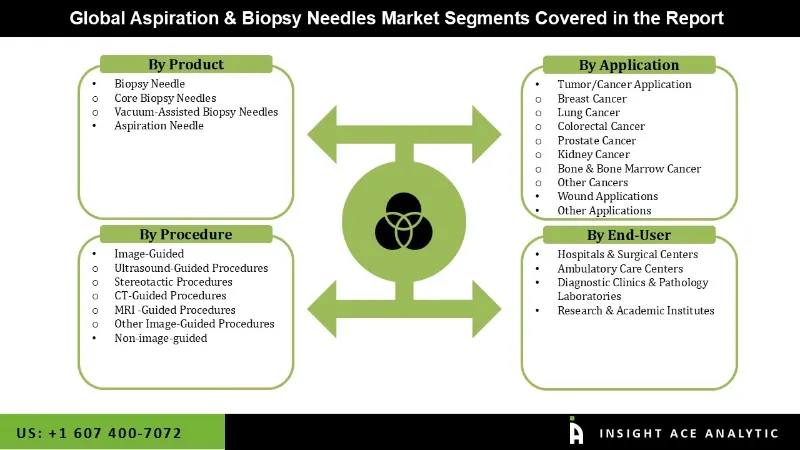

Aspiration & Biopsy Needles Market Size, Share & Trends Analysis Report By Product (Biopsy Needle (Core Biopsy Needles, Vacuum-Assisted Biopsy Needles), Aspiration Needle), By Application, By Procedure, By End-User, By Region, And By Segment Forecasts, 2026 to 2035

The market is being driven by factors such as the rising incidence of cancer, increased knowledge of the condition and available treatments, patient preference for minimally invasive surgeries, rising healthcare costs, and technological developments in image-guided biopsy systems.

According to Globocan 2020, there will be 2,261,419 new patients of breast cancer in 2020, & there will be 684,996 deaths worldwide as a result of breast cancer. Also, the same source shows that breast cancer is the most prevalent cancer among all cancers. The increased use of needle-based biopsy instruments for breast cancer testing is a result of the rising incidence and mortality of malignancies like breast cancer, showing the rapid expansion of this industry.

Additionally, governments worldwide are launching campaigns to increase cancer awareness and its diagnosis to enable early cancer detection. For instance, the health minister of Tamil Nadu, an Indian state, claimed in February 2022 that the government of Tamil Nadu is formulating a policy to identify 66% of cancer patients in the first and second stages by 2030, allowing for the provision of appropriate treatment. Therefore, it is anticipated that these policies will fuel market expansion.

In addition, throughout the anticipated period, the market is expected to be propelled by technical advances, product launches, and merger and acquisition activity by significant market participants. For example, in January 2021, Incorporating Somatex Medical Technologies with Hologic Inc. Hologic's strategy aims to offer an extensive array of cutting-edge solutions for every stage of breast health care.

The Aspiration & Biopsy Needles market is segmented based on product, application, procedure, and end-user. The market is segmented as biopsy needles and aspiration needles based on product. The application segment includes tumour/cancer application, breast cancer, lung cancer, colorectal cancer, prostate cancer, kidney cancer, bone & bone marrow cancer, other cancers, wound applications, and other applications.

The procedure segment includes Image-guided, and Non-image guided. Based on End-User, the segmentation is hospital & surgical centres, diagnostic clinics & pathology laboratories, ambulatory care centres, and research & academic institutes.

Globally, the incidence of breast cancer has dramatically increased in recent years, increasing the desire for more effective and precise treatment methods and, consequently, the market's expansion. According to the World Health Organization's March 2021 report, 685,000 women died from breast cancer in 2020, with an estimated 2.3 mn new cases. Breast cancer is among the ordinary types of cancer, with 7.8 million women alive today having received a diagnosis in the previous five years. Owing to the rising spread of breast cancer, there will be a greater need for breast biopsies, which will raise demand for biopsy and aspiration needles and spur sector expansion.

Throughout the projection period, the image-guided category is anticipated to experience stable revenue growth. The increased demand for image-guided needle biopsy treatments is primarily due to the ease of discovery because it allows the clinician to examine problematic spots that are either easily visible or cannot be felt through the skin. The growing popularity of minimally invasive biopsy is a key driver promoting the expansion of this market.

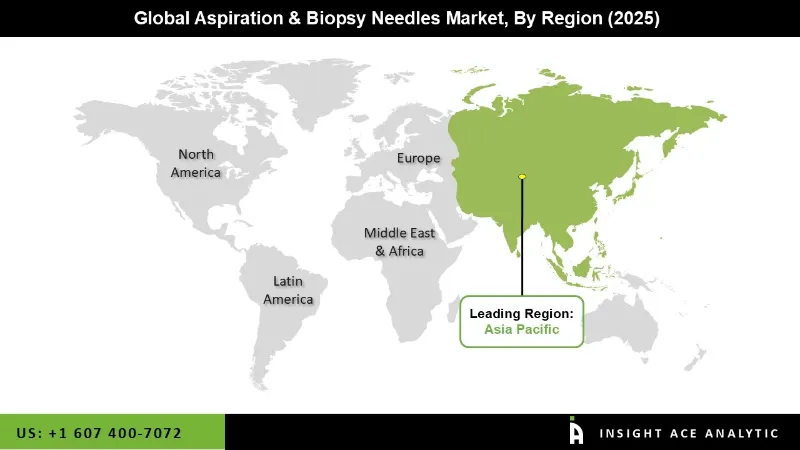

Due to the rising cancer prevalence, increased awareness of early cancer diagnosis, high healthcare spending, and the rising number of approved devices, Asia Pacific dominates the global market. It is predicted that a rise in cancer prevalence will raise the need for aspiration and biopsy needles for early diagnosis, ultimately fueling the market expansion in the area.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.14 Bn |

| Revenue Forecast In 2035 | USD 2.38 Bn |

| Growth Rate CAGR | CAGR of 7.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million, volume (number of units) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Application, Procedure, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | CONMED Corporation (US), Medtronic Plc (Ireland), Olympus Corporation (Japan), Becton, Dickinson and Company (US), Boston Scientific Corporation (US), Cook Group Incorporated (US), Argon Medical Devices, Inc (US), INRAD Inc. (US), Somatex Medical Technologies (Germany), Stryker Corporation (US), Cardinal Health (US), Remington Medical (US), Rantac Corporation (US), HAKKO CO., LTD (Japan), and Merit Medical Systems (US) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Aspiration & Biopsy Needles Market By Product-

Aspiration & Biopsy Needles Market By Application-

Aspiration & Biopsy Needles Market By Procedure-

Aspiration & Biopsy Needles Market By End-User-

Aspiration & Biopsy Needles Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.