Global AI in Mining and Natural Resources Market Size is valued at USD 5.4 Bn in 2024 and is predicted to reach USD 35.2 Bn by the year 2034 at a 20.6% CAGR during the forecast period for 2025-2034.

Artificial intelligence has become a disruptive factor in the natural resources and mining sector. This field aims to transform resource extraction and management by utilizing AI technologies like computer vision and machine learning. AI's capacity to interpret mining businesses may improve worker safety protocols, make data-driven decisions, and maximize exploration efforts by analyzing large databases. Additionally, in dangerous mining locations, AI-powered autonomous trucks and equipment can lower operating hazards and boost production.

Artificial intelligence in mining and natural resources has a lot of potential to advance sustainable practices, boost operational effectiveness, and satisfy the growing demand for essential natural resources worldwide.The growing necessity for effective and sustainable resource management is a key impetus in the mining sector. Extensive data processing and analytical insights from AI enhance decision-making, thereby reducing environmental impact, decreasing operational expenses, and streamlining exploration and extraction processes.

AI in the mining and natural resources market is segmented by type, application, and end user. Based on type, the market is segmented into machine learning, computer vision, natural language processing, and robotics. By application, the market is segmented as exploration and geological analysis, mine planning and design, autonomous vehicles and equipment, predictive maintenance, safety and risk assessment, environmental monitoring and management, supply chain optimization, resource extraction and processing, and mine closure and rehabilitation. By end-user, the market is segmented into mining companies, mining equipment manufacturers, consulting and service providers, and research and academia.

The market is expanding due in large part to its critical role in exploration and geological analysis, where AI makes target identification, geological modelling, and efficient data processing possible. AI improves scheduling, resource allocation, and layouts in mine planning and design, resulting in more economical and sustainable mining operations. While predictive maintenance solutions reduce downtime and boost equipment reliability, autonomous vehicles and equipment that integrate artificial intelligence (AI) improve automation and safety in demanding mining conditions—AI-powered data analytics help Safety and Risk Assessment by offering real-time insights to avert potential dangers and mishaps.

Predictive maintenance is another current use of AI in mining. Mining companies have reduced downtime and increased the lifespan of both fixed and mobile assets by employing machine learning (ML) algorithms to evaluate equipment data and detect breakdowns before they happen. In addition to saving money, this strategy increases safety by reducing the likelihood of incidents involving equipment.

Due to significant R&D investments, technological developments, and partnerships between mining businesses and AI technology providers, North America is at the forefront of the implementation of AI in mining. The market is thriving in Europe as a result of the region's emphasis on environmentally friendly mining methods, legislative backing, and the presence of top suppliers of AI solutions. With nations like Australia and China making significant investments in AI technology to improve safety, optimize mining operations, and satisfy resource demands, Asia Pacific offers potential for rapid growth. While the Middle East and Africa see growing AI integration for resource exploration and extraction, supporting the region's economic development, Latin America embraces AI-driven technologies to increase efficiency and productivity in the mining sector.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 5.4 Bn |

|

Revenue Forecast In 2034 |

USD 35.2 Bn |

|

Growth Rate CAGR |

CAGR of 20.6% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Type, Application, End-User |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

|

Competitive Landscape |

IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., Caterpillar Inc., Komatsu Ltd., Sandvik AB, Hexagon AB, ABB Ltd., Rockwell Automation, Inc., Hitachi Construction Machinery Co., Ltd., NVIDIA Corporation, SAP SE, Cisco Systems, Inc., Wenco International Mining Systems Ltd., BHP Group, Rio Tinto Group, Vale S.A., Anglo American plc, Freeport-McMoRan Inc., Newmont Corporation, Teck Resources Limited, Glencore plc, Gold Fields Limited, Barrick Gold Corporation. |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global AI in Mining and Natural Resources Market Snapshot

Chapter 4. Global AI in Mining and Natural Resources Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Type Estimates & Trend Analysis

5.1. by Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Type:

5.2.1. Machine Learning

5.2.2. Computer Vision

5.2.3. Natural Language Processing

5.2.4. Robotics

Chapter 6. Market Segmentation 2: by End User Estimates & Trend Analysis

6.1. by End User & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End User:

6.2.1. Mining Companies

6.2.2. Mining Equipment Manufacturers

6.2.3. Consulting and Service Providers

6.2.4. Research and Academia

Chapter 7. Market Segmentation 3: by Application Estimates & Trend Analysis

7.1. by Application & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Application:

7.2.1. Exploration and Geological Analysis

7.2.2. Mine Planning and Design

7.2.3. Autonomous Vehicles and Equipment

7.2.4. Predictive Maintenance

7.2.5. Safety and Risk Assessment

7.2.6. Environmental Monitoring and Management

7.2.7. Supply Chain Optimization

7.2.8. Resource Extraction and Processing

7.2.9. Mine Closure and Rehabilitation

Chapter 8. AI in Mining and Natural Resources Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

8.1.2. North America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

8.1.3. North America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.1.4. North America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

8.2.2. Europe AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

8.2.3. Europe AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.2.4. Europe AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

8.3.2. Asia Pacific AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

8.3.3. Asia-Pacific AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.3.4. Asia Pacific AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.4. Latin America

8.4.1. Latin America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

8.4.2. Latin America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

8.4.3. Latin America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.4.4. Latin America AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Type, 2021-2034

8.5.2. Middle East & Africa AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

8.5.3. Middle East & Africa AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.5.4. Middle East & Africa AI in Mining and Natural Resources Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. IBM Corporation

9.2.2. Google LLC

9.2.3. Microsoft Corporation

9.2.4. Amazon Web Services, Inc.

9.2.5. Caterpillar Inc.

9.2.6. Komatsu Ltd.

9.2.7. Sandvik AB

9.2.8. Hexagon AB

9.2.9. ABB Ltd.

9.2.10. Rockwell Automation, Inc.

9.2.11. Hitachi Construction Machinery Co., Ltd.

9.2.12. NVIDIA Corporation

9.2.13. SAP SE

9.2.14. Cisco Systems, Inc.

9.2.15. Wenco International Mining Systems Ltd.

9.2.16. BHP Group

9.2.17. Rio Tinto Group

9.2.18. Vale S.A.

9.2.19. Anglo American plc

9.2.20. Freeport-McMoRan Inc.

9.2.21. Newmont Corporation

9.2.22. Teck Resources Limited

9.2.23. Glencore plc

9.2.24. Gold Fields Limited

9.2.25. Barrick Gold Corporation

9.2.26. Other Market Players

AI In Mining And Natural Resources Market By Product-

AI In Mining And Natural Resources Market By Application-

AI In Mining And Natural Resources Market By End-User-

AI In Mining And Natural Resources Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

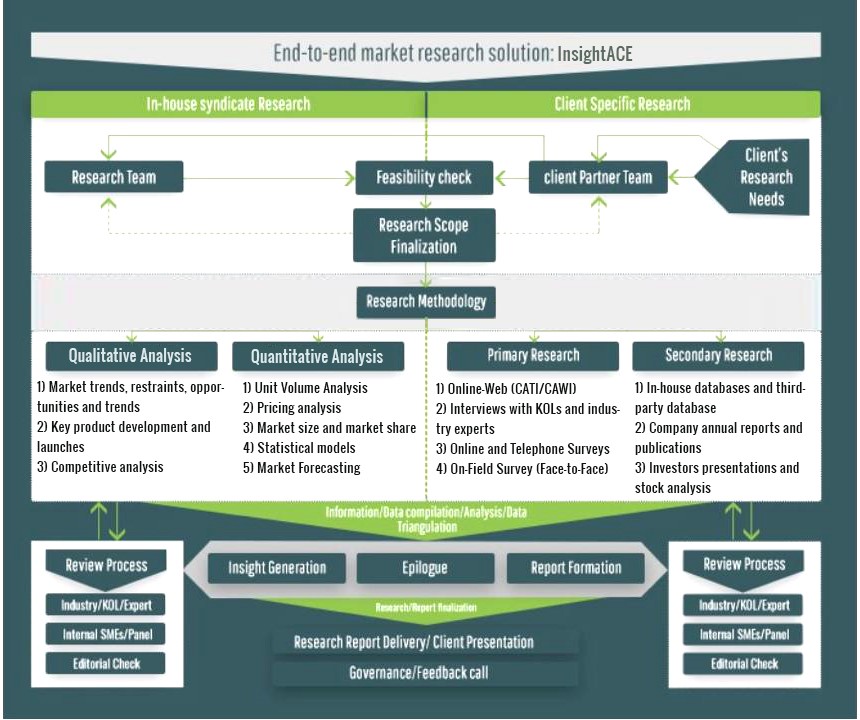

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.