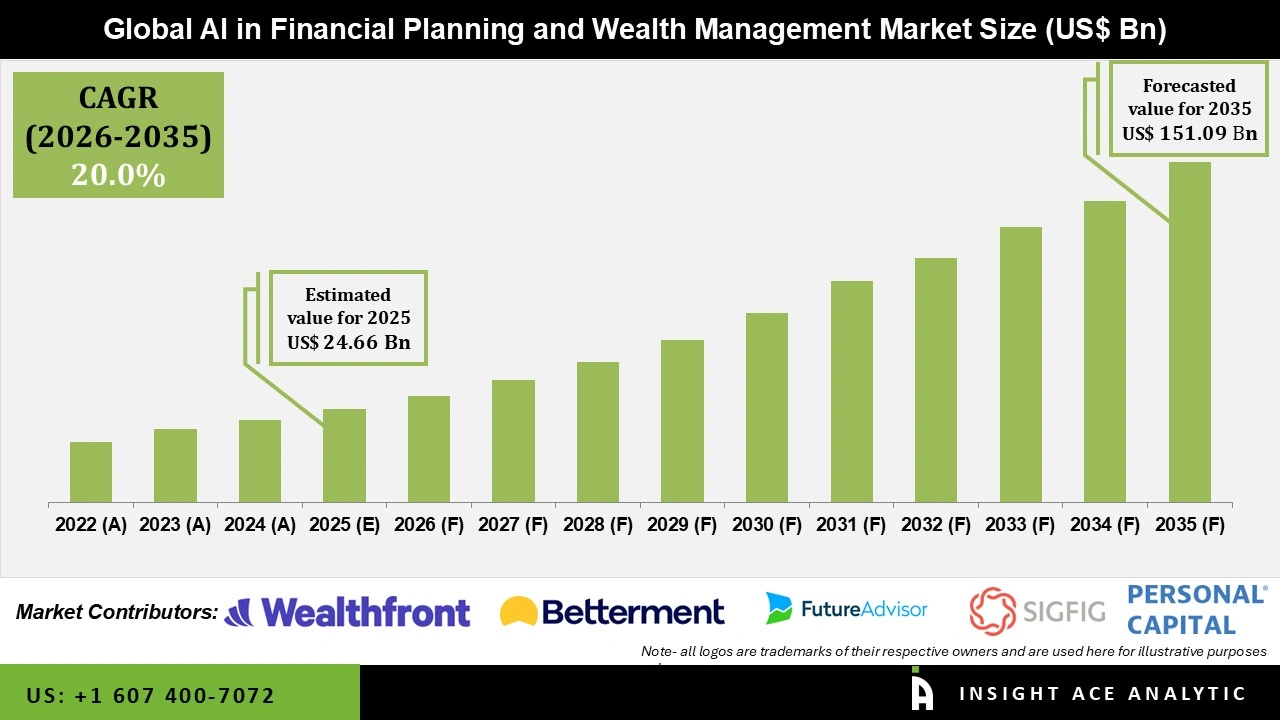

Global AI in Financial Planning and Wealth Management Market Size is valued at USD 24.66 Bn in 2025 and is predicted to reach USD 151.09 Bn by the year 2035 at a 20.00% CAGR during the forecast period for 2026 to 2035.

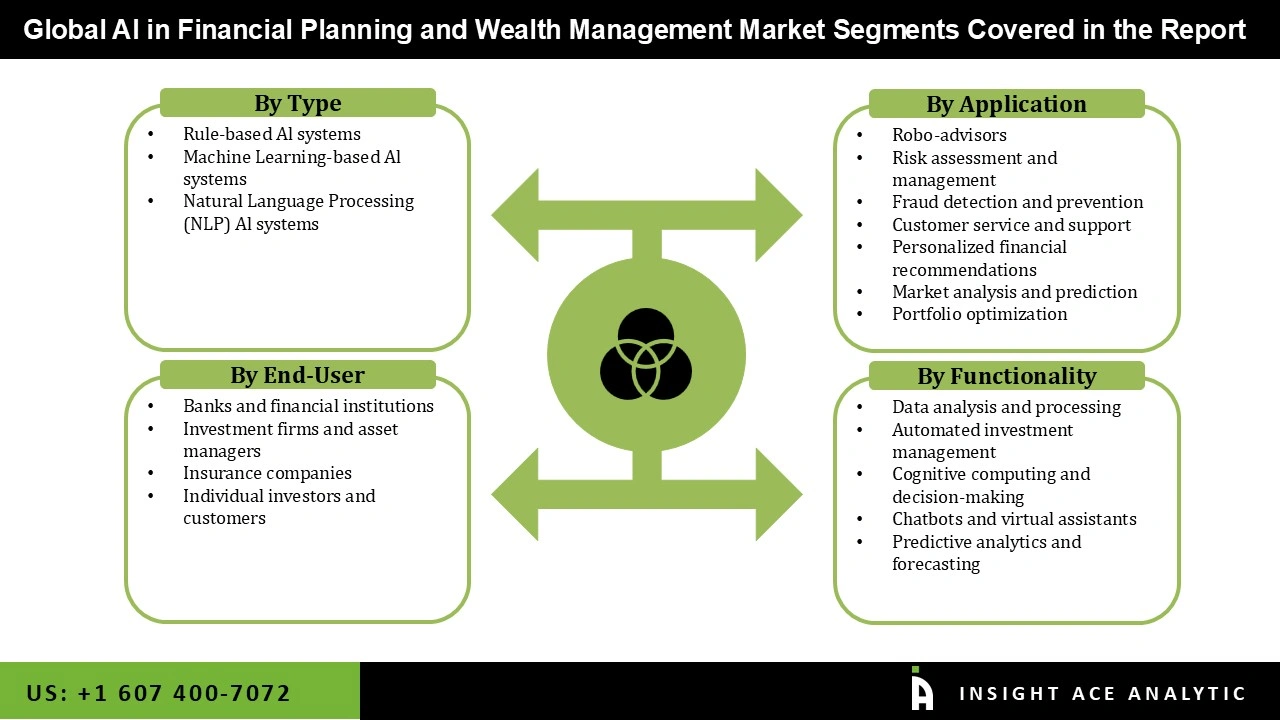

AI in Financial Planning and Wealth Management Market Size, Share & Trends Analysis Report By Product (Rule-based Al systems, Machine Learning-based Al systems, Natural Language Processing (NLP) Al systems), By Application, By End-user, By Functionality, By Region, And By Segment Forecasts, 2026 to 2035.

AI in Financial Planning and Wealth Management Market Key Takeaways:

|

AI in the financial planning and wealth management industry has been growing in recent years, although leading wealth managers have been using AI and machine learning for years. As AI technology advances, the way the financial sector operates changes, enabling significant improvements and creating new opportunities for wealth management firms. According to OT, driven by client demand and increased expectations of wealth management services, AI is enabling customization and personalization at scale, targeting improved communication with clients, which is more seamless, value-adding, and real-time.

In addition, AI can help relationship managers in wealth management build stronger relationships with clients, helping them, based on best practices, to become more effective in client acquisition, client development, client activation, and client retention.

Important drivers of this market include the rising adoption of AI-driven robo-advisors, which provide automated, algorithm-based portfolio management advice with minimal human intervention. These platforms offer cost-effective, personalized financial planning to a broader audience, including those previously underserved by traditional financial advisors. Additionally, wealth management firms must comply with a vast array of regulations, which can vary between jurisdictions and evolve. Compliance requirements seek to protect clients' interests, maintain market integrity, and prevent financial crime. AI can help wealth management firms and managers comply with rules and regulations by automating tasks such as identifying suspicious activities, monitoring transactions, and reporting them to regulators. However, AI must be transparent and accountable.

The AI in Financial Planning and Wealth Management market is segmented on the basis of product, application, end-user, and functionality. As per the product, the market is segmented into rule-based Al systems, machine learning-based Al systems, and natural language processing (NLP) Al systems. By application, the market is segmented into Robo-advisors, Risk assessment and management, Fraud detection and prevention, Customer service and support, personalized financial recommendations, Market analysis and prediction, and Portfolio optimization. Based on end-users, the market is segmented into banks and financial institutions, investment firms and asset managers, insurance companies, individual investors, and customers. The functionality segment includes Data analysis and processing, automated investment management, Cognitive computing and decision-making, Chatbots and virtual assistants, Predictive analytics, and forecasting.

The Rule-based Al systems category is expected to lead with a major share in the global AI in Financial Planning and Wealth Management market. These systems operate on predefined rules and logic to provide financial advice and manage wealth. They are specifically useful for automating repetitive tasks, such as portfolio rebalancing, tax-loss harvesting, and compliance checks. Rule-based AI systems enhance efficiency and reduce operational costs by eliminating manual interventions. In North America, the adoption of these systems is driven by a mature financial sector and stringent regulatory requirements. At the same time, the Asia Pacific region sees rapid growth due to increasing digitalization and financial inclusion efforts. These systems are crucial for delivering consistent and reliable financial services, thereby improving client satisfaction and trust in AI-driven financial planning solutions.

The robo-advisors segment is projected to grow rapidly in the global AI in Financial Planning and Wealth Management market owing to automated platforms leveraging AI algorithms to provide significant investment advice and portfolio management with minimal human intervention. Robo-advisors analyze vast amounts of financial data, assess risk tolerance, and offer tailored recommendations, making investment accessible and affordable to a broader audience. Their ability to operate 24/7, coupled with lower fees compared to traditional financial advisors, has fueled their popularity, especially among tech-savvy millennials and cost-conscious investors. As AI technology continues to advance, robo-advisors are expected to become more sophisticated, offering increasingly precise and customized financial planning solutions, thereby driving significant growth in the financial planning and wealth management market.

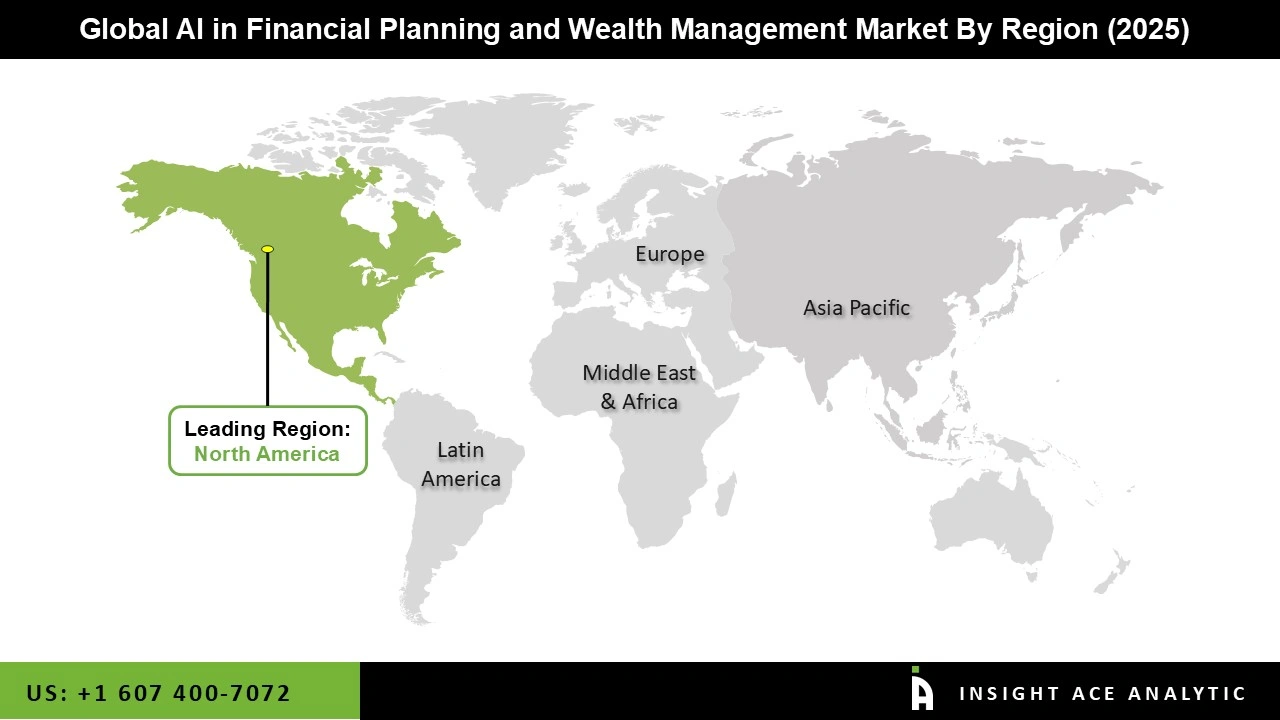

The North American AI in Financial Planning and Wealth Management market holds a significant revenue share due to several factors. The region boasts advanced technological infrastructure, high adoption rates of AI technologies, and a robust financial sector. The presence of leading financial institutions and wealth management firms drives the demand for AI solutions to enhance customer experiences, optimize investment strategies, and improve operational efficiency.

Additionally, regulatory support for technological innovation and a well-established data analytics ecosystem further contribute to market growth. The increasing need for personalized financial advice and the growing adoption of AI-driven tools for risk management, fraud detection, and compliance are key drivers propelling the market's expansion in North America.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 24.66 Bn |

| Revenue Forecast In 2035 | USD 151.09 Bn |

| Growth Rate CAGR | CAGR of 20.00% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Application, End-User and Functionality |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | WealthFront, Betterment, Personal Capital, FutureAdvisor, SigFig, WiseBanyan, Nutmeg, Acorns, Charles Schwab Intelligent Portfolios, Vanguard Personal Advisor Services, BlackRock, and Fidelity Go. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.