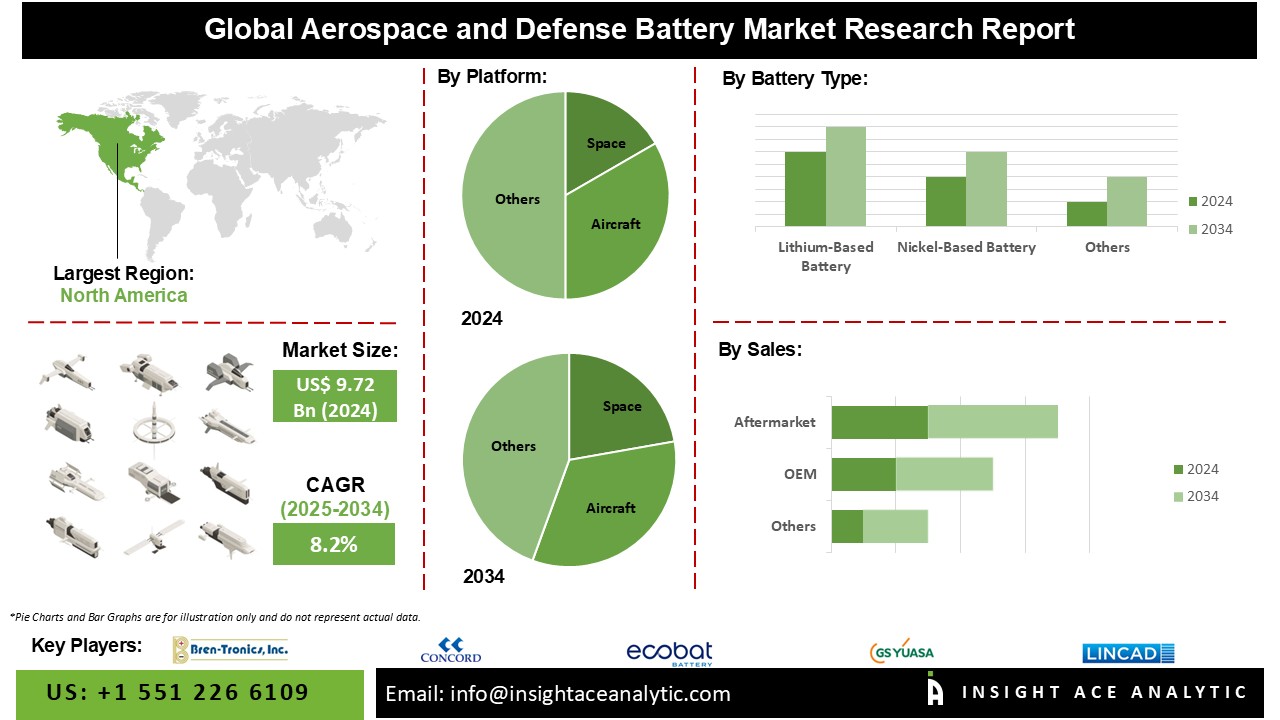

Aerospace and Defense Battery Market Size is valued at USD 9.72 Bn in 2024 and is predicted to reach USD 21.17 Bn by the year 2034 at a 8.2% CAGR during the forecast period of 2025-2034.

Batteries are a source of power for a wide array of applications in the aerospace and defence industries. Some examples of these applications include aeroplanes, spacecraft, missiles, unmanned aerial vehicles (UAVs), military vehicles, communication systems, and a wide variety of electronic gadgets. Given the demanding and frequently mission-critical nature of aerospace and defence applications, these batteries must meet strict standards for energy density, dependability, safety, and performance. The rise of the aircraft battery market can be attributed to different causes, including the need to implement more electrical solutions to ensure the long-term performance of aviation systems and aircraft safety. The demand for helicopters and business jets to deliver medical supplies, freight, VIPs, and charter flights has significantly increased.

However, the COVID-19 epidemic has significantly impacted the aerospace and defence sectors of the economy, as well as the market for batteries utilized in these sectors. The pandemic brought forth a number of difficulties and disruptions that had an impact on demand, supply chains, manufacturing, and research and development initiatives.

The Aerospace and Defense Battery Market is segmented on the basis of application, battery type, and sales. Based on application, the market consists of space (Satellite, Launch Vehicle, Deep Space), aircraft (Military, Civil & Commercial), UAV (Military, Civil & Commercial), and defence (Ground Based, Marine Based. The battery type segment includes Lithium-Based Battery (Lithium Polymer Battery, Lithium-Ion Battery), Nickel-Based Battery (Nickel-Cadmium (NiCd) Battery, Nickel-Metal Hydride Battery), Thermal Battery, and others. By sales, the market is segmented into OEM Aftermarket.

The UAV category is expected to hold a major share of the global Aerospace and Defense Battery Market in 2024. Unmanned aerial vehicles (UAVs) have become essential components of modern military operations, surveillance, and civilian applications. The increasing need for longer endurance and higher cargo capacity is one of the most significant developments affecting this industry. This involves the development of new battery technologies capable of supporting complex payloads such as high-resolution cameras and sensors and offering prolonged flight durations.

The Lithium-Ion Battery category is projected to grow at a rapid rate in the global Aerospace and Defense Battery Market. Lithium-ion (or Li-ion) batteries are smaller, require less maintenance, and are safer for the environment than nickel-cadmium (also known as NiCad, NiCd, or Ni-Cd) batteries. As a result, the use of lithium-ion batteries is expected to grow at the fastest rate when compared to other types during the projected period.

The North America Aerospace and Defense Battery Market is expected to record the maximum market revenue share in the near future. The existence of a greater number of established defence and aerospace firms, as well as high-capacity battery producers, is propelling the regional market. A convergence of variables influences the regional market, including defence investments, electrification efforts, sustainability concerns, and collaborative research activities. These trends are projected to continue altering the market landscape, making it an important region for industry players and investors. Moreover, Asia Pacific is expected to increase at a significant rate over the forecast period. Many Asian Pacific countries have increased their defence budgets, modernising military equipment such as advanced aircraft, naval vessels, and ground-based systems. As a result, high-performance batteries are in high demand.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 9.72 Bn |

|

Revenue Forecast In 2034 |

USD 21.17 Bn |

|

Growth Rate CAGR |

CAGR of 8.2% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Bn, Volume (Unit), and CAGR from 2024 to 2031 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Application, Battery Type, Sales |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

|

Competitive Landscape |

Bren-Tronics, Inc., Concorde, ECOBAT, GS Yuasa International Ltd., Lincad, Navitas System, SAFT, Sion Power Corporation, WAE Technologies Limited, Shift, DENCHI POWER, Kokam, Enersys, EXIDE Technologies, Mathew Associates, Navitas Systems, Teledyne Technologies, Cell-Con, Leclanche Sa, Sterling Planb Energy Solutions, Lifeline Batteries, BST Systems, Inc., Eaglepicher Technologies, Arotech Corporation, Ultralife Corporation, Korea Special Battery Co., Ltd., Others |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Aerospace and Defense Battery Market Snapshot

Chapter 4. Global Aerospace and Defense Battery Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: By Platform Estimates & Trend Analysis

5.1. By Platform, & Market Share, 2024 & 2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Platform:

5.2.1. Space

5.2.1.1. Satellite

5.2.1.2. Launch Vehicle

5.2.1.3. Deep Space

5.2.2. Aircraft

5.2.2.1. Military

5.2.2.2. Civil and Commercial

5.2.3. UAV

5.2.3.1. Military

5.2.3.2. Civil and Commercial

5.2.4. Defense

5.2.4.1. Ground Based

5.2.4.2. Marine Based

Chapter 6. Market Segmentation 2: By Battery Type Estimates & Trend Analysis

6.1. By Battery Type & Market Share, 2024 & 2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Battery Type:

6.2.1. Lithium-Based Battery

6.2.1.1. Lithium Polymer Battery

6.2.1.2. Lithium-Ion Battery

6.2.2. Nickel-Based Battery

6.2.2.1. Nickel-Cadmium (NiCd) Battery

6.2.2.2. Nickel-Metal Hydride Battery

6.2.3. Thermal Battery

6.2.4. Others

Chapter 7. Market Segmentation 3: By Sales Estimates & Trend Analysis

7.1. By Sales & Market Share, 2019 & 2031

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2019 to 2031 for the following By Sales:

7.2.1. OEM

7.2.2. Aftermarket

Chapter 8. Aerospace and Defense Battery Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Aerospace and Defense Battery Market revenue (US$ Million) estimates and forecasts By Platform, 2021-2034

8.1.2. North America Aerospace and Defense Battery Market revenue (US$ Million) estimates and forecasts By Battery Type, 2021-2034

8.1.3. North America Aerospace and Defense Battery Market revenue (US$ Million) estimates and forecasts By Sales, 2021-2034

8.1.4. North America Aerospace and Defense Battery Market revenue (US$ Million) estimates and forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Aerospace and Defense Battery Market revenue (US$ Million) By Platform, 2021-2034

8.2.2. Europe Aerospace and Defense Battery Market revenue (US$ Million) By Battery Type, 2021-2034

8.2.3. Europe Aerospace and Defense Battery Market revenue (US$ Million) By Sales, 2021-2034

8.2.4. Europe Aerospace and Defense Battery Market revenue (US$ Million) by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Aerospace and Defense Battery Market revenue (US$ Million) By Platform, 2021-2034

8.3.2. Asia Pacific Aerospace and Defense Battery Market revenue (US$ Million) By Battery Type, 2021-2034

8.3.3. Asia Pacific Aerospace and Defense Battery Market revenue (US$ Million) By Sales, 2021-2034

8.3.4. Asia Pacific Aerospace and Defense Battery Market revenue (US$ Million) by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Aerospace and Defense Battery Market revenue (US$ Million) By Platform, (US$ Million) 2021-2034

8.4.2. Latin America Aerospace and Defense Battery Market revenue (US$ Million) By Battery Type, (US$ Million) 2021-2034

8.4.3. Latin America Aerospace and Defense Battery Market revenue (US$ Million) By Sales, (US$ Million) 2021-2034

8.4.4. Latin America Aerospace and Defense Battery Market revenue (US$ Million) by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Aerospace and Defense Battery Market revenue (US$ Million) By Platform, (US$ Million) 2021-2034

8.5.2. Middle East & Africa Aerospace and Defense Battery Market revenue (US$ Million) By Battery Type, (US$ Million) 2021-2034

8.5.3. Middle East & Africa Aerospace and Defense Battery Market revenue (US$ Million) By Sales, (US$ Million) 2021-2034

8.5.4. Middle East and Africa Aerospace and Defense Battery Market revenue (US$ Million) by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Bren-Tronics, Inc.

9.2.2. Concorde

9.2.3. ECOBAT

9.2.4. GS Yuasa International Ltd.

9.2.5. Lincad

9.2.6. Navitas System

9.2.7. Saft

9.2.8. Sion Power Corporation

9.2.9. WAE Technologies Limited

9.2.10. Shift

Aerospace and Defense Battery Market By Application-

Aerospace and Defense Battery Market By Battery Type-

Aerospace and Defense Battery Market By Sales-

Aerospace and Defense Battery Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.