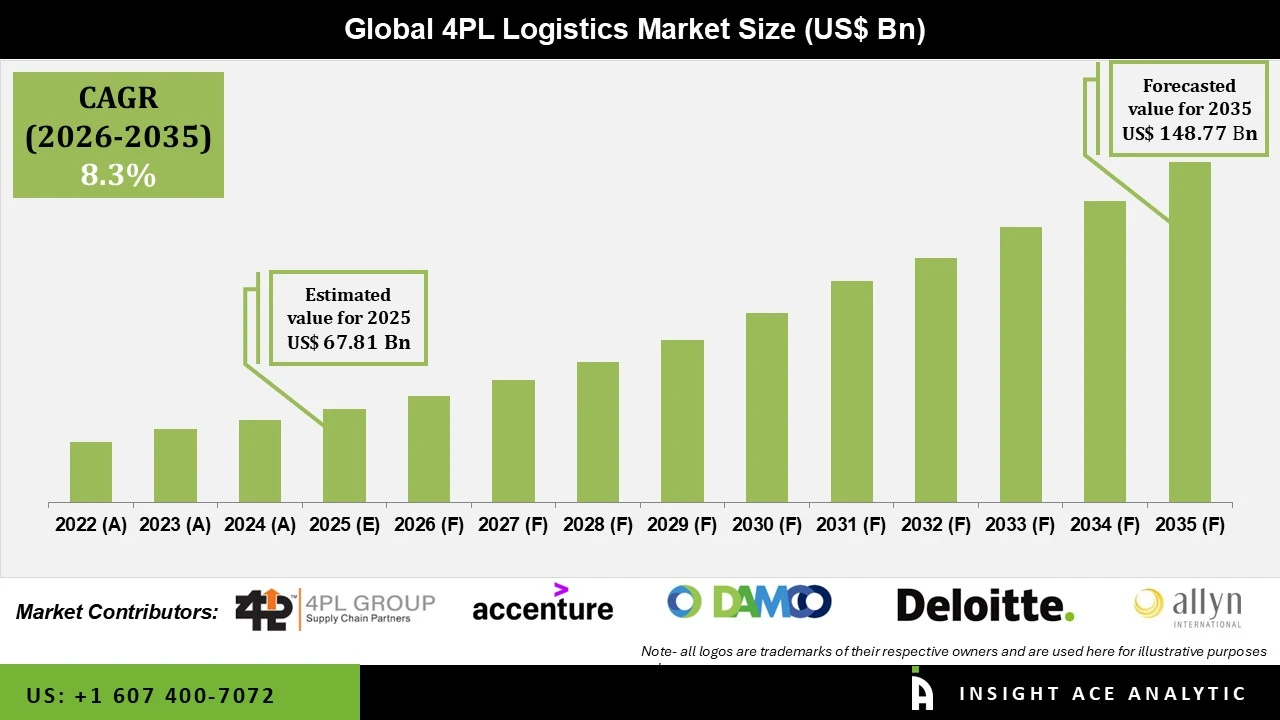

4PL Logistics Market Size is valued at USD 67.81 Billion in 2025 and is predicted to reach USD 148.77 Billion by the year 2035 at an 8.30% CAGR during the forecast period for 2026 to 2035.

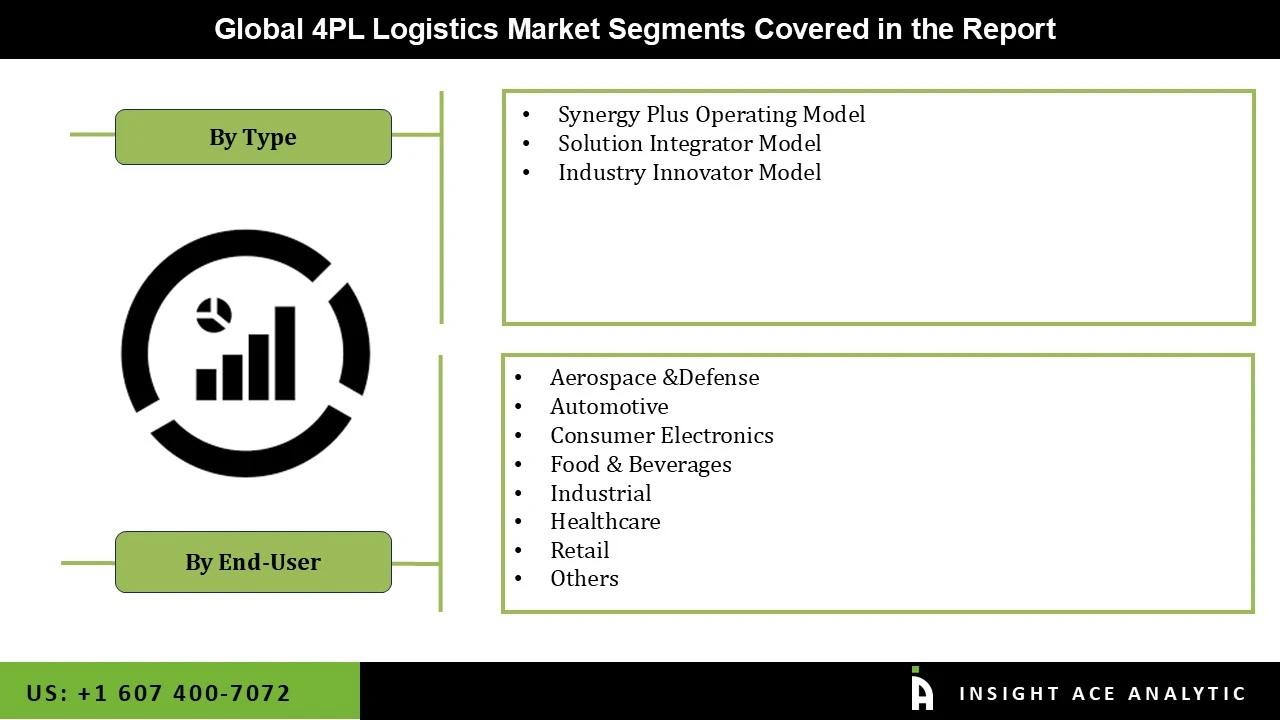

4PL Logistics Market Size, Share & Trends Analysis Report By Product (Synergy Plus Operating Model, Solution Integrator Model And Industry Innovator Model) And End User (Aerospace & Defense, Automotive, Consumer Electronics, Food & Beverages, Industrial, Healthcare, Retail), By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Distribution network services are another name for fourth-party logistics (4PL) services. Logistics is the organization of collecting, storing, and transferring commodities to their destination. The need for fourth-party logistics has increased significantly over the last few years. For managing incoming raw materials, dynamic transportation, demand-driven logistics, and international incidental music, fourth-party logistics has a lot to offer. The key reasons behind the commercialization are the rising demand for inbound logistic services, mainly from the manufacturing sector, and the increasing need for straightforward logistical processes from distributors and manufacturers. Inbound logistics services are in great demand, notably from the industrial sector. Retailers and manufacturers also have an increasing need for simple logistics. These are the main elements fueling the market's expansion.

Additionally, many organizations provide enhanced customer service, adaptability, and total operation cost, which motivates companies to engage supply chain suppliers. The need for these services to deliver small and large products is rising due to the potential growth of the e-commerce industry, creating more lucrative chances for market expansion globally.

Furthermore, due to the rising demand for an efficient supply chain, the global 4PL logistics market is anticipated to expand. The 4PL supply chain is prevalent across many industries because it offers businesses straightforward supply chain operations. The exponential expansion of the electronic sector is advancing the sector. Companies that sell electronic goods are more likely to invest in supply chains run by third parties to offer doorstep delivery services to their clients.

The 4PL Logistics market is segmented based on product and end user. Based on type, the market is segmented as synergy plus operating model, solution integrator model and industry innovator model. By end user, the 4PL Logistics market is segmented into aerospace & defense, automotive, consumer electronics, food & beverages, industrial, healthcare, retail and others.

The solution integrator model category will hold a major share of the global 4PL Logistics market in 2021. Integration of the solution provides more intelligent organizational operations by connecting disparate processes. As organizational complexity impacts an organization's capacity to compete and generate profit, businesses are beginning to recognize the significance of implementation. One of the main drivers of the expansion of the solution integrator market is the rising adoption of the Internet of Things (IoT), rising breakthroughs in cloud technologies, and rising investments in decentralized information systems, including real-time process control and communications networks.

The consumer electronics segment is projected to grow rapidly in the global 4PL Logistics market. Consumer electronics manufacturers are investing in third-party transportation services to support customer doorstep delivery due to the consumer electronics sector's spectacular global growth. Some factors, including the changing lifestyles of the populace, the adoption of technologically advanced products, and increasing per capita income, can be used to explain the consumer electronics industry's spectacular rise., particularly in countries such as the US, Germany, the UK, China, and India.

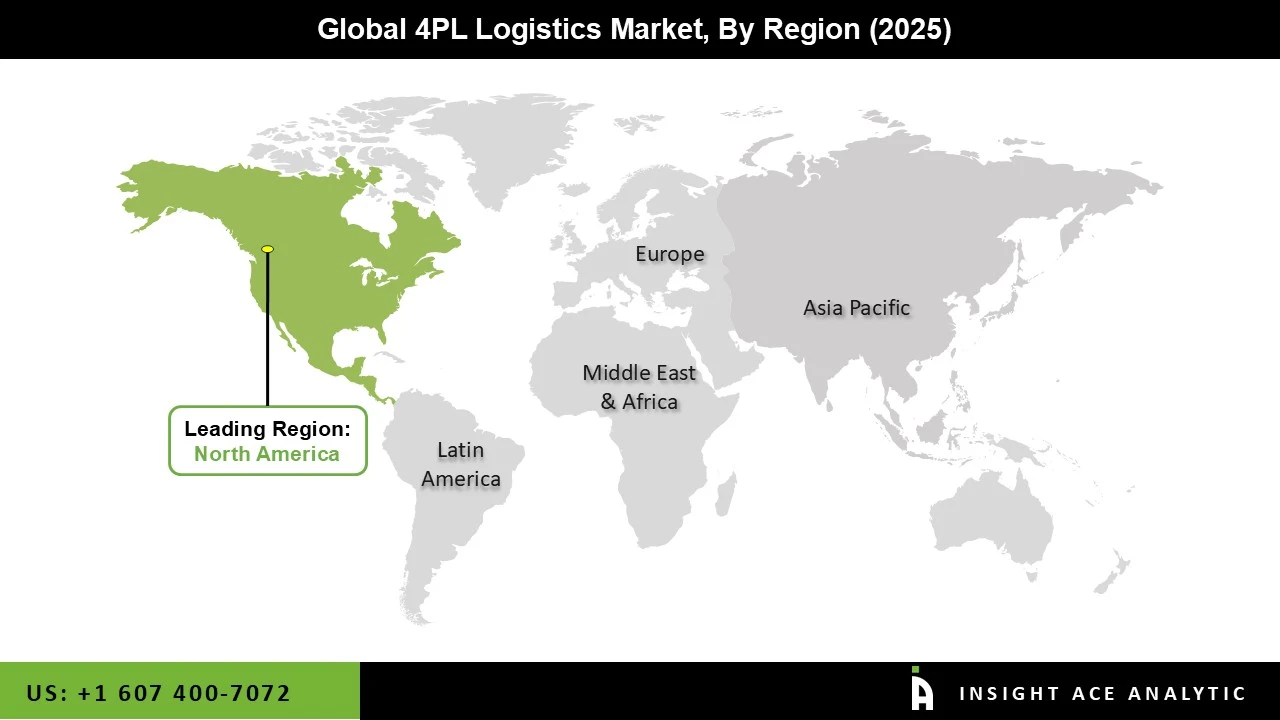

The North America 4PL Logistics market is expected to register the highest market share in revenue soon. Because there are so many corporate businesses in North America, the market is expanding quickly. North America is using new technologies and techniques to address the rising demand for supply chain services. In addition, the Asia Pacific region is projected to grow rapidly in the global 4PL Logistics market. E-commerce is becoming increasingly well-liked in emerging nations, which has helped to create this enormous industry share. The sectors in developing countries like South Korea, India, Japan, and China are significantly responsible for their economies' expansion. These services are offered throughout the region by sizable businesses. The 4PL Logistics market growth is anticipated to be fueled by rising demand for a third-party supply chain from different online retailers.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 67.81 Billion |

| Revenue forecast in 2035 | USD 148.77 Billion |

| Growth rate CAGR | CAGR of 8.30% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2025 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product And End User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | 4PL Group, 4PL Insights, Accenture Consulting, Allyn International Services, Inc., C.H Robinson Worldwide, Ltd., CEVA Logistics, DAMCO, DB Schenker, Deloitte, Deutsche Post AG, GEFCO Group, Global4PL Supply Chain Services, Logistics Plus Inc., Panalpina World Transport, United Parcel Service, Inc., and XPO Logistics, Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

4PL Logistics Market By Type

4PL Logistics Market By End-User

4PL Logistics Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.