Global Viral and Non-Viral Vector Manufacturing Market Size is valued at USD 8.0 Billion in 2024 and is predicted to reach USD 56.8 Billion by the year 2034 at a 21.9% CAGR during the forecast period for 2025-2034.

Viral vectors are genetically modified viruses utilised as carriers for introducing exogenous genetic material into cells through their viral genome. In contrast, nonviral vectors encompass a range of chemical vectors, including inorganic particles, lipid-based vectors, polymer-based vectors, and peptide-based vectors, which also serve as vehicles for delivering foreign genetic material into cells.

Viral vectors are used to convey genetic material into cells and have become a popular method for gene transfer due to their high transfection effectiveness, sustained gene expression, and efficient gene delivery. Plasmid DNA is essential in the healthcare industry, as it is used as a therapeutic agent in gene therapy and the production of vaccine antigens.

The growing usage of gene therapy to treat viral infections such as adeno-associated viruses, poxviruses, herpes simplex viruses, and retroviruses is expected to boost gene therapy acceptance, which will help to push viral vector and plasmid DNA manufacturing market expansion. Furthermore, demand for viral vectors and plasmid DNA production is expected to rise in the next years due to the rising need for DNA treatments and cancer research R&D. The partnership focused on increasing the chromatographic separation of AAV-based vectors using several AAV types. As a result, such collaborations are expected to improve the manufacturing efficiency and scalability of gene therapies, allowing for the global availability of viral vectors and creating lucrative market opportunities. Gene treatments are being developed via viral vectors and plasmid DNA, which is one of the fastest expanding areas in advanced medicines.

Healthcare companies are developing DNA vectors for vaccine manufacturing. Many challenges affect the manufacturers of viral vectors and plasmid DNA whose products are in phase III clinical trials and commercial production of viral vectors. Many existing vector production technologies are inadequate in terms of productivity, efficiency, stability, and other factors.

The Viral and Non-Viral Vector Manufacturing market is segmented based on vector type, diseases, and application. Based on vector type, the market is segmented as Viral Vector (Adenoviral Vector, Retroviral Vector, Adeno-Associated Viral Vector, Lentiviral Vector, Vaccinia Viral Vector, Other Viral Vector), Non-Viral Vectors, (Plasmid DNA, Lipid-Based Non-Viral Vector, Polymer-Based Non-Viral Vector, Other Non-Viral Vector (Peptide-Based and Hybrid/Combination)). Based on application, the market is categorized into gene therapy, vaccinology, cell therapy and other applications. The market is segmented based on diseases includes Cancer, Genetic Disorder, and Infectious diseases.

The Non-Viral vectors category is expected to hold a significant share in the global Viral and Non-Viral Vector Manufacturing market in 2021. The COVID-19 viral vector vaccines use non-replicating viral vectors. The market will continue to increase as more non-viral vectors are used in vaccine development in the occurrence of a pandemic. According to a PubMed paper published in 2017, the development of non-viral DNA vectors has progressed substantially, particularly in the reduction of plasmid vector length. This factor is also playing a vital role in the segment's growth.

The vaccinology segment is projected to proliferate in the global Viral and Non-Viral Vector Manufacturing market. This is because viral vectors are regularly used in vaccine development due to their efficiency benefits. Positives include the ability to encourage a comprehensive immunological response, as well as the safety profiles and convenience of manufacture. Furthermore, the European Medicines Agency (EMA) has approved the use of AAV in clinical trials since it may express epitomal genes without integrating into the host genome. In addition, attempts to design and enhance immunization schedules will drive the development of novel vaccines, especially in countries such as the US, Germany, the UK, China, and India.

The North America Viral and Non-Viral Vector Manufacturing market is expected to register the highest market share in terms of revenue soon due to the presence of a significant number of research centres engaged in advanced therapy research and development. Furthermore, the construction of manufacturing units by competitors from other countries in North America is a driving force behind the region's market expansion. In addition, Asia Pacific is projected to grow at a rapid rate in the global Viral and Non-Viral Vector Manufacturing market. This is due to the creation of accelerated approval processes, the growing pool of patient population, growing private and government investments, and rising healthcare requirements. Furthermore, the unmet demands in the field of personalized medicine are driving the growing demand for viral vectors.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 8.0 Billion |

|

Revenue Forecast In 2034 |

USD 56.8 Billion |

|

Growth Rate CAGR |

CAGR of 21.9% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Mn,and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Vector type, By Disease, By Application |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

|

Competitive Landscape |

Boehringer Ingelheim, Catalent, Inc., FUJIFILM Holdings Corporation, Danaher Corporation, Rescript Biotech Corporation, Lonza Group AG, Merck Kagan Inc., Oxford Biomedical plc, Sartorius AG, Takara Bio Inc, Thermo Fisher Scientific Inc, Wuxi Optec, Acuities Therapeutic, Evonik Industries AG, Exiled, Inc., Entos Pharmaceuticals, Genevant Sciences GmbH, T&T Scientific Corporation, Moderna, Inc and CureVac N.V. |

|

Customization Scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Viral and Non-Viral Vector Manufacturing Market Snapshot

Chapter 4. Global Viral and Non-Viral Vector Manufacturing Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: By Vector Types Estimates & Trend Analysis

5.1. By Vector Types & Market Share, 2024 & 2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Vector Types:

5.2.1. Viral Vector

5.2.1.1. Adenoviral Vector

5.2.1.2. Retroviral Vector

5.2.1.3. Adeno-Associated Viral Vector

5.2.1.4. Lentiviral Vector

5.2.1.5. Vaccinia Viral Vector

5.2.1.6. Other Viral Vector

5.2.2. Non-Viral Vectors

5.2.2.1. Plasmid DNA

5.2.2.2. Lipid-Based Non-Viral Vector

5.2.2.3. Polymer-Based Non-Viral Vector

5.2.2.4. Other Non-Viral Vector (Peptide-Based and Hybrid/Combination)

Chapter 6. Market Segmentation 2: By Diseases Estimates & Trend Analysis

6.1. By Diseases & Market Share, 2024 & 2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Diseases:

6.2.1. Cancer

6.2.2. Genetic Disease

6.2.3. Infectious Disease

6.2.4. Cardiovascular Disease

6.2.5. Other Diseases

Chapter 7. Market Segmentation 3: By Applications Estimates & Trend Analysis

7.1. By Applications & Market Share, 2024 & 2034

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Applications:

7.2.1. Gene Therapy

7.2.1.1. Viral Vector

7.2.1.2. Non-Viral Vector

7.2.2. Vaccinology

7.2.2.1. Viral Vector

7.2.2.2. Non-Viral Vector

7.2.3. Cell Therapy

7.2.3.1. Viral Vector

7.2.3.2. Non-Viral Vector

7.2.4. Other Applications

7.2.4.1. Viral Vector

7.2.4.2. Non-Viral Vector

Chapter 8. Viral and Non-Viral Vector Manufacturing Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts By Vector Types, 2021-2034

8.1.2. North America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts By Diseases, 2021-2034

8.1.3. North America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts by Applications, 2021-2034

8.1.4. North America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Vector Types, 2021-2034

8.2.2. Europe Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Diseases, 2021-2034

8.2.3. Europe Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts by Applications, 2021-2034

8.2.4. Europe Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Vector Types, 2021-2034

8.3.2. Asia Pacific Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Diseases, 2021-2034

8.3.3. Asia Pacific Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts by Applications, 2021-2034

8.3.4. Asia Pacific Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Vector Types, 2021-2034

8.4.2. Latin America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Diseases, 2021-2034

8.4.3. Latin America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts by Applications, 2021-2034

8.4.4. Latin America Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Vector Types, 2021-2034

8.5.2. Middle East & Africa Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) By Diseases, 2021-2034

8.5.3. Middle East & Africa Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) estimates and forecasts by Applications, 2021-2034

8.5.4. Middle East & Africa Viral and Non-Viral Vector Manufacturing Market revenue (US$ Million) by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Boehringer Ingelheim

9.2.2. Catalent, Inc.

9.2.3. FUJIFILM Holdings Corporation

9.2.4. Danaher Corporation

9.2.5. Genscript Biotech Corporation

9.2.6. Lonza Group AG

9.2.7. Merck KGaA Inc.

9.2.8. Oxford Biomedica plc

9.2.9. Sartorius AG

9.2.10. Takara Bio Inc.

9.2.11. Thermo Fisher Scientific Inc.

9.2.12. Wuxi AppTec

9.2.13. Acuitas Therapeutics

9.2.14. Evonik Industries AG

9.2.15. Exelead, Inc.

9.2.16. Entos Pharmaceuticals

9.2.17. Genevant Sciences GmbH

9.2.18. T&T Scientific Corporation

9.2.19. Moderna, Inc.

9.2.20. CureVac N.V.

9.2.21. Cognate BioServices Inc. (Cobra Biologics)

9.2.22. Genezen Laboratories

9.2.23. Yposkesi

9.2.24. Waisman Biomanufacturing

9.2.25. Advanced Bioscience Laboratories, Inc. (Abl Inc.)

9.2.26. Novasep Holding S.A.S.

9.2.27. Batavia Biosciences B.V.

9.2.28. Biovion Oy

9.2.29. Sirion Biotech Gmbh.

9.2.30. Virovek Incorporation

9.2.31. Biontech Imfs Gmbh

9.2.32. Vivebiotech S.L.

9.2.33. Creative Biogene

9.2.34. Uniqure NV

9.2.35. Cell and Gene Therapy Catapult

9.2.36. Cevec. Pharmaceuticals Gmbh

9.2.37. Other Prominent Players

By Vector Type

By Disease

By Application

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

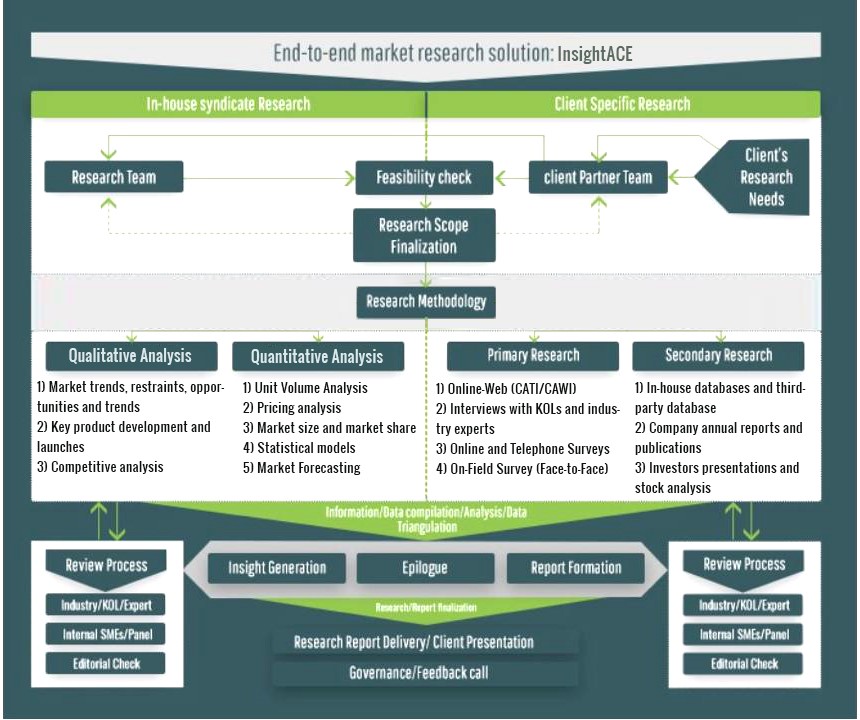

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.