Paper Packaging Market Size is valued at 370.76 billion in 2024 and is predicted to reach 595.33 billion by the year 2034 at a 4.9% CAGR during the forecast period for 2025-2034.

Paper packing refers to packaging made of papers and boards. Cartridge paper, Kraft paper, recycled paper, and other materials are used for paper packaging. Some of the various types of paper packaging goods used in the fast food, fresh food, dairy and bakery, frozen foods, pet food, cosmetics, and pharmaceutical industries include Tetra packs, cartons, folding boxes, sacks, bags, and corrugated cases. Paper packaging materials have advantages over other packaging materials like metal and plastic since they can be easily recycled and reused. One of the key factors driving the expansion of this industry is the lightweight, affordable, and environmentally friendly nature of paper packaging materials.

Furthermore, this market is anticipated to expand quickly due to the rising demand for flexible paper packaging as consumers become more conscious of the adverse environmental effects of plastics. Furthermore, the paper packaging industry in these countries is anticipated to be driven by the BRIC nations' robust economies. The market demand for paper packaging is predicted to rise as the packaging business expands since paper continues to be the most common material used in packaging. During the projection period, the market is anticipated to develop more slowly than average due to the strict deforestation restrictions in several nations worldwide. The impending ban on light plastic bags presents this sector's opportunity to expand—a significant switch from rigid to flexible packaging, which helps boost the market.

The Paper Packaging market is segregated by grade, product, and end-user industry. The market is segmented into carton board, containerboard, and other grades based on grade. By the product, the market is segmented into Folding Cartons, Corrugated Boxes, and Other Types. The end-use industry segments the market as Food, Beverage, Personal Care, Healthcare, Household Care, Electrical Products, and Other End User Industries.

Due to their widespread use in milk and juice box packaging, folding packaging cartons make up the most significant product category of paper packaging materials. The market for corrugated cases is anticipated to stimulate product demand as they are increasingly used in retail packaging as a result of advancements in design innovation. Furthermore, corrugated issues, which are lightweight, reusable, recyclable, and highly robust, are anticipated to rise quickly, stimulating the demand for paper packaging. Throughout the following years, there will likely be a significant increase in the demand for cartons and folding boxes as ornamental and bulk packaging become more and more popular.

Due to the rise in the consumption of juices and functional beverages, beverages made up the most significant application category for paper packaging. Due to the rising use of paper to wrap and enclose food products, application categories such as fresh foods, frozen foods, and fast foods are predicted to exhibit substantial expansion in the paper packaging materials market over the course of the forecast period. The need for paper packaging is also anticipated to increase as a result of technological advancements in food applications, such as the creation of laminated and coated papers that resist leaking. Because it adds value to food and other products through efficiency, adaptability, innovation, and sustainability, paper packaging is predicted to increase at the quickest rate in the packaging market.

Due to a rise in flexible packaging, North America and Europe have experienced substantial growth in recent years, accounting for more than half of the global market for paper packaging materials. Due to the expansion of the region's entire packaging sector, the Asia Pacific market is anticipated to experience the quickest growth for paper packaging in the future years. Due to the developing packaging sector in these nations and the rising per capita spending of consumers in these regions, the roW is anticipated to capture a sizable market share throughout the projection period. Globally, there will be a greater demand for paper packaging as consumption and demand for consumer goods rise.

|

Report Attribute |

Specifications |

|

Market size value in 2024 |

USD 370.76 Bn |

|

Revenue forecast in 2034 |

USD 595.33 Bn |

|

Growth rate CAGR |

CAGR of 4.9% from 2025 to 2034 |

|

Quantitative units |

Representation of revenue in US$ Billion, Volume (Tons) and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report coverage |

The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments covered |

Grade, Product, And End-User Industry |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

|

Competitive Landscape |

International Paper Company, Mondi Group, Smurfit Kappa Group, DS Smith PLC, WestRock Company, Packaging Corporation of America, Cascades Inc., Holdings Corporation, Nippon Paper Industries Ltd., Rengo Co. Ltd., Graphic Packaging International, Metsä Board Oyj, Sonoco Products Company, Visy Industries, and Seaboard Folding Box Company Inc. |

|

Customization scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and available payment methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Paper Packaging Market Snapshot

Chapter 4. Global Paper Packaging Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Grade Estimates & Trend Analysis

5.1. by Grade & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn) & Volume (Tons)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Grade:

5.2.1. Carton Board

5.2.1.1. Solid bleached sulphate (SBS)

5.2.1.2. Solid unbleached sulphate (SUS)

5.2.1.3. Folding boxboard (FBB)

5.2.1.4. Coated Recycled Board (CRB)

5.2.1.5. Uncoated recycled board (URB)

5.2.2. Containerboard

5.2.2.1. White-top Kraftliner

5.2.2.2. Other Kraftliners

5.2.2.3. White top Testliner

5.2.2.4. Other Testliners

5.2.2.5. Semi Chemical Fluting

5.2.2.6. Recycled Fluting

5.2.3. Other grades

Chapter 6. Market Segmentation 2: by Product Estimates & Trend Analysis

6.1. by Product & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn) & Volume (Tons)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Product:

6.2.1. Folding Cartons

6.2.2. Corrugated Boxes

6.2.3. Other Types

Chapter 7. Market Segmentation 3: by End-use Industry Estimates & Trend Analysis

7.1. by End-use Industry & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn) & Volume (Tons)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End-use Industry:

7.2.1. Food

7.2.2. Beverage

7.2.3. Healthcare

7.2.4. Personal Care

7.2.5. Household Care

7.2.6. Electrical Products

7.2.7. Other End User Industries

Chapter 8. Paper Packaging Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Grade, 2021-2034

8.1.2. North America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Product, 2021-2034

8.1.3. North America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by End-use Industry, 2021-2034

8.1.4. North America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Grade, 2021-2034

8.2.2. Europe Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Product, 2021-2034

8.2.3. Europe Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by End-use Industry, 2021-2034

8.2.4. Europe Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Grade, 2021-2034

8.3.2. Asia Pacific Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Product, 2021-2034

8.3.3. Asia-Pacific Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by End-use Industry, 2021-2034

8.3.4. Asia Pacific Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Grade, 2021-2034

8.4.2. Latin America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Product, 2021-2034

8.4.3. Latin America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by End-use Industry, 2021-2034

8.4.4. Latin America Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Grade, 2021-2034

8.5.2. Middle East & Africa Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by Product, 2021-2034

8.5.3. Middle East & Africa Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by End-use Industry, 2021-2034

8.5.4. Middle East & Africa Paper Packaging Market Revenue (US$ Million) & Volume (Tons) Estimates and Forecasts by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. International Paper Company

9.2.2. Mondi Group

9.2.3. Smurfit Kappa Group

9.2.4. DS Smith PLC

9.2.5. WestRock Company

9.2.6. Packaging Corporation of America

9.2.7. Cascades Inc.

9.2.8. Holdings Corporation

9.2.9. Nippon Paper Industries Ltd.

9.2.10. Rengo Co. Ltd.

9.2.11. Graphic Packaging International

9.2.12. Metsä Board Oyj

9.2.13. Sonoco Products Company

9.2.14. Visy Industries

9.2.15. Seaboard Folding Box Company Inc.

9.2.16. Georgia-Pacific Corporation

9.2.17. Other Prominent Players

Paper Packaging Market By Grade-

Paper Packaging Market By Product-

Paper Packaging Market By End Use Industry-

Paper Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

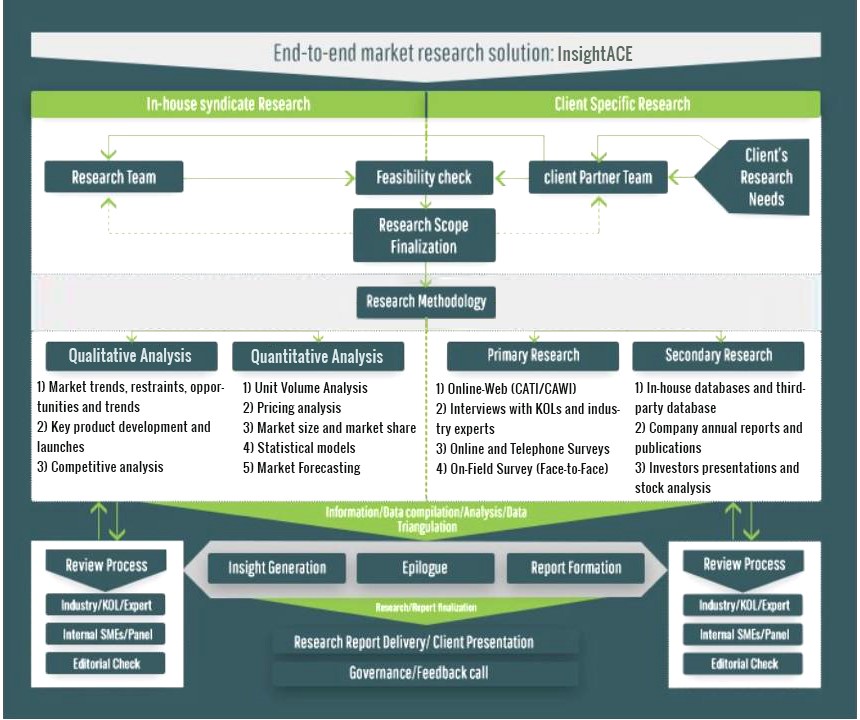

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.