Low-Carbon Cement Alternatives Market Size Was valued at USD 8.5 Bn in 2024 and is predicted to reach USD 30.3 Bn by 2034 at a 13.7% CAGR during the forecast period for 2025-2034.

Low-carbon cement alternatives are novel materials designed to mitigate the environmental impact of conventional Portland cement, a significant contributor to carbon dioxide (CO?) emissions worldwide. These substitutes aim to preserve or enhance the strength and durability of traditional cement while minimising the carbon footprint during production. Blended cement that uses industrial byproducts like fly ash, slag, and silica fume instead of clinker—the most carbon-intensive part of cement—are common low-carbon substitutes. The growing demand for sustainable building materials and rising urbanisation, particularly in developing nations, are two factors driving the market's growth.

Additionally, there is an increasing need of SCMs, such as slag, fly ash, and silica fume, due to stringent environmental regulations and an increasing emphasis on sustainable construction methods. These environmentally friendly cement substitutes lower trash disposal and carbon emissions. Market demand for low-carbon cement substitutes is increasing as the industry seeks more ecologically friendly ways to meet legal requirements and environmental objectives.

While research into alkali-activated materials and geopolymers is gaining significant momentum, the industry is undergoing a shift toward blended cement with lower clinker percentages. Furthermore, the market is expanding, particularly in North America and Europe, due to the introduction of carbon curing technologies, the integration of digital technologies for optimum mix designs, and the increase of bio-based additives and alternative activators.

The low-carbon cement alternatives market is segmented based on raw material, type, application, and end-user. Based on raw material, the market is segmented into industrial byproducts (fly ash, slag, silica fume), alternative calcium sources, natural pozzolans, novel binding materials, calcined clays, and others. By type, the market is segmented into calcium sulfoaluminate cement (CSA), alkali-activated materials, supplementary cementitious materials (SCM) blends, geopolymer cement, and magnesium-based cement. By application, the market is segmented into ready-mix concrete, structural concrete, non-structural applications, precast concrete products, and others. By end-user, the market is segmented into infrastructure development, residential construction, commercial construction, industrial facilities, and others.

The supplementary cementitious materials (SCM) blends segment is expected to hold a major global market share in 2024 mainly because they have a proven track record of success, are familiar to construction professionals, and are very simple to integrate into current production processes. These materials have broad regulatory acceptance and provide a useful compromise between technological performance and carbon reduction. On the other hand, due to its superior early strength development, lower production energy requirements, and growing commercial availability, the Calcium Sulfoaluminate Cement (CSA) category is anticipated to grow at the fastest CAGR.

Given its extensive use in construction projects of all sizes, its capacity to precisely control mixture proportions in centralized facilities, and the industry's strong emphasis on sustainability certifications, the ready-mix concrete segment is anticipated to hold the largest share of the overall low-carbon cement alternatives market. However, during the forecast period, the structural concrete segment is anticipated to grow at the fastest rate due to the growing performance validation of substitute cement for load-bearing applications and the increased awareness of green building projects that use sustainable structural materials.

The North American low-carbon cement alternatives market is expected to register the highest market share in revenue in the near future driven by regionally aggressive climate targets, strict carbon restrictions, and established carbon pricing mechanisms. Furthermore, consumer awareness and robust green building certification systems are important factors in industry supremacy. In addition, Asia Pacific is projected to grow rapidly in the global low-carbon cement alternatives market supported by expanding state-level procurement regulations that demand low-carbon materials and business sustainability programs. In addition, tremendous infrastructural development, fast urbanization, and stricter environmental rules in nations like China and India are the main factors of this rapid expansion.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 8.5 Bn |

|

Revenue Forecast In 2034 |

USD 30.3 Bn |

|

Growth Rate CAGR |

CAGR of 13.7% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Raw Material, By Type, By Application, By End-User, and By Region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

|

Competitive Landscape |

CarbiCrete, Zeobond Pty Ltd, Holcim Group, HeidelbergCement AG, CRH plc, Ecocem Materials Ltd., Calix Limited, Ceratech Inc., CEMEX S.A.B. de C.V., BioMason Inc., Solidia Technologies, CarbonCure Technologies Inc., Terra CO2 Technologies, LC3 Technology, and others. |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Applicationology and Scope

1.1. Research Applicationology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Low-Carbon Cement Alternatives Market Snapshot

Chapter 4. Global Low-Carbon Cement Alternatives Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Porter's Five Forces Analysis

4.7. Incremental Opportunity Analysis (US$ MN), 2025-2034

4.8. Global Low-Carbon Cement Alternatives Market Penetration & Growth Prospect Mapping (US$ Mn), 2024-2034

4.9. Competitive Landscape & Market Share Analysis, By Key Player (2024)

4.10. Use/impact of AI on LOW-CARBON CEMENT ALTERNATIVES MARKET Industry Trends

Chapter 5. Low-Carbon Cement Alternatives Market Segmentation 1: By Product Type, Estimates & Trend Analysis

5.1. Market Share by Product Type, 2024 & 2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Product Type:

5.2.1. Supplementary Cementitious Materials (SCM) Blends

5.2.2. Geopolymer Cement

5.2.3. Calcium Sulfoaluminate Cement (CSA)

5.2.4. Alkali-Activated Materials

5.2.5. Magnesium-Based Cement

Chapter 6. Low-Carbon Cement Alternatives Market Segmentation 2: By Raw Material, Estimates & Trend Analysis

6.1. Market Share by Raw Material, 2024 & 2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Raw Material:

6.2.1. Industrial By-products

6.2.1.1. Fly Ash

6.2.1.2. Slag

6.2.1.3. Silica Fume

6.2.2. Natural Pozzolans

6.2.3. Calcined Clays

6.2.4. Alternative Calcium Sources

6.2.5. Novel Binding Materials

6.2.6. Others

Chapter 7. Low-Carbon Cement Alternatives Market Segmentation 3: By Application, Estimates & Trend Analysis

7.1. Market Share by Application, 2024 & 2034

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following Application:

7.2.1. Structural Concrete

7.2.2. Non-structural Applications

7.2.3. Precast Concrete Products

7.2.4. Ready-Mix Concrete

7.2.5. Others

Chapter 8. Low-Carbon Cement Alternatives Market Segmentation 4: By End User, Estimates & Trend Analysis

8.1. Market Share by End User, 2024 & 2034

8.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following End User:

8.2.1. Commercial Construction

8.2.2. Residential Construction

8.2.3. Infrastructure Development

8.2.4. Industrial Facilities

8.2.5. Others

Chapter 9. Low-Carbon Cement Alternatives Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. Global Low-Carbon Cement Alternatives Market , Regional Snapshot 2024 & 2034

9.2. North America

9.2.1. North America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.2.1.1. US

9.2.1.2. Canada

9.2.2. North America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.2.3. North America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Raw Material, 2021-2034

9.2.4. North America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.2.5. North America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.3. Europe

9.3.1. Europe Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.3.1.1. Germany

9.3.1.2. U.K.

9.3.1.3. France

9.3.1.4. Italy

9.3.1.5. Spain

9.3.1.6. Rest of Europe

9.3.2. Europe Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.3.3. Europe Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Raw Material, 2021-2034

9.3.4. Europe Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.3.5. Europe Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.4. Asia Pacific

9.4.1. Asia Pacific Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.4.1.1. India

9.4.1.2. China

9.4.1.3. Japan

9.4.1.4. South Korea

9.4.1.5. Southeast Asia

9.4.1.6. Rest of Asia Pacific

9.4.2. Asia Pacific Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.4.3. Asia Pacific Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Raw Material, 2021-2034

9.4.4. Asia Pacific Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts By Application, 2021-2034

9.4.5. Asia Pacific Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.5. Latin America

9.5.1. Latin America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Country, 2021-2034

9.5.1.1. Brazil

9.5.1.2. Mexico

9.5.1.3. Argentina

9.5.1.4. Rest of Latin America

9.5.2. Latin America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.5.3. Latin America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Raw Material, 2021-2034

9.5.4. Latin America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.5.5. Latin America Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

9.6. Middle East & Africa

9.6.1. Middle East & Africa Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.6.1.1. GCC Countries

9.6.1.2. South Africa

9.6.1.3. Rest of Middle East and Africa

9.6.2. Middle East & Africa Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

9.6.3. Middle East & Africa Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Raw Material, 2021-2034

9.6.4. Middle East & Africa Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

9.6.5. Middle East & Africa Low-Carbon Cement Alternatives Market Revenue (US$ Million) Estimates and Forecasts by End User, 2021-2034

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. Holcim Group

10.2.1.1. Business Overview

10.2.1.2. Key Product/Service

10.2.1.3. Financial Performance

10.2.1.4. Geographical Presence

10.2.1.5. Recent Developments with Business Strategy

10.2.2. HeidelbergCement AG

10.2.3. CEMEX S.A.B. de C.V.

10.2.4. CRH plc

10.2.5. Solidia Technologies

10.2.6. Carbicrete

10.2.7. CarbonCure Technologies Inc.

10.2.8. Ecocem Materials Ltd.

10.2.9. Calix Limited

10.2.10. Ceratech Inc.

10.2.11. BioMason Inc.

10.2.12. Terra CO2 Technologies

10.2.13. CarbiCrete

10.2.14. Zeobond Pty Ltd

10.2.15. LC3 Technology

10.2.16. Other Market Players

Low-Carbon Cement Alternatives Market- By Raw Material

Low-Carbon Cement Alternatives Market- By Type

Low-Carbon Cement Alternatives Market- By Application

Low-Carbon Cement Alternatives Market- By End-User

Low-Carbon Cement Alternatives Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

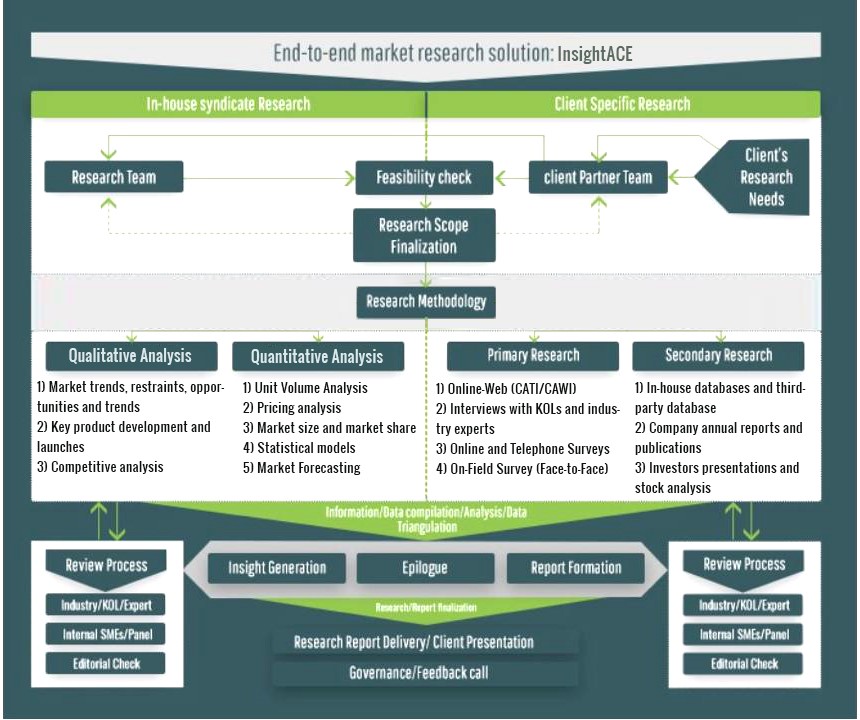

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.