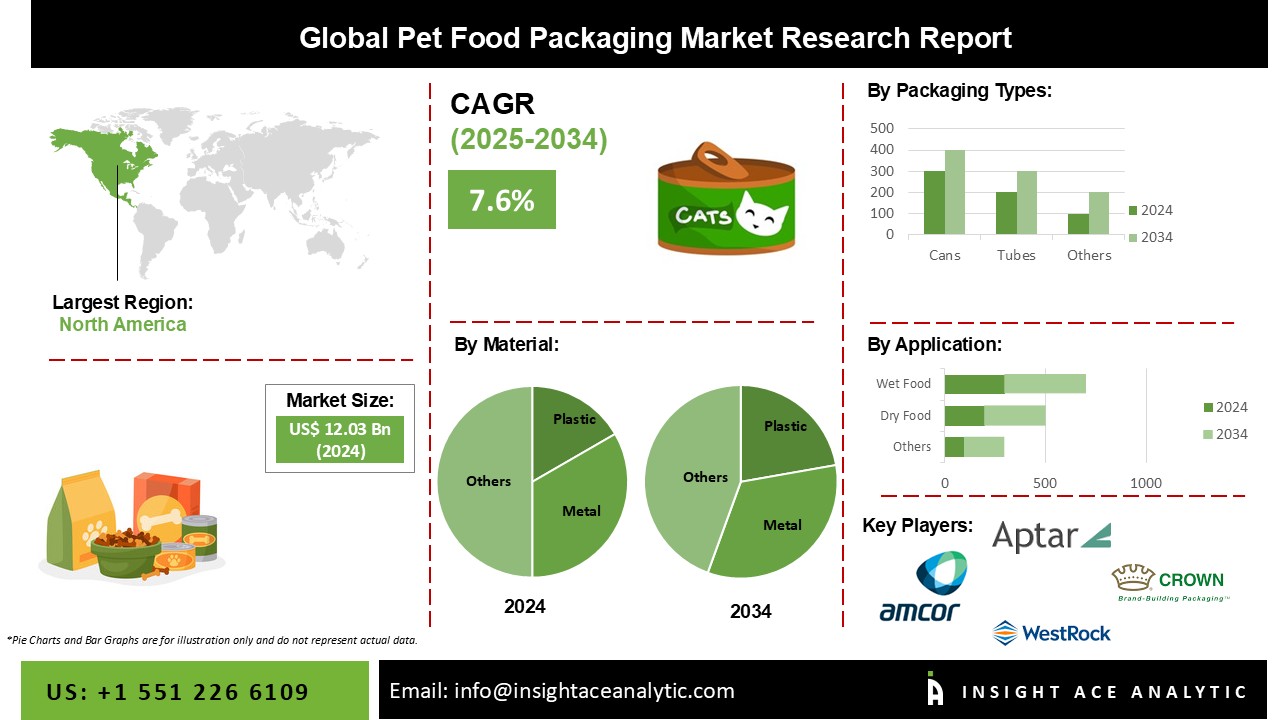

Pet Food Packaging Market Size is valued at 12.03 Billion in 2024 and is predicted to reach 24.90 Billion by the year 2034 at a 7.6% CAGR during the forecast period for 2025-2034.

Increased pet adoption, rising disposable income of pet owners, and multi-functionality of pet care packaging are driving the growth of the pet food packaging market. Plastic, laminate, metal, and aluminium are common materials used in pet food packaging. Pet food that has been improved and manufactured specifically is usually sold in compact packages with superior presentation. Plastic is a popular choice for pet food packaging. Furthermore, food packaging materials pose a number of hazards, which governments around the world have addressed through a range of regulations. Pet adoption is driven by higher disposable incomes and nuclear households, which are boosting the pet care sector. Furthermore, the pet food packaging market is being driven by the increased popularity of internet channels, as well as the ability to contact specialists such as veterinarians remotely via telehealth or other online choices. Premium pet items, such as organic pet foods and pet grooming services, are becoming increasingly popular among pet owners.

Factors such as higher incomes and nuclear homes are driving pet adoption, which is strengthening the pet food industry. Furthermore, the rising popularity of internet channels and the ability to communicate with specialists such as veterinarians remotely via telehealth or other online options is driving the pet care business. Organic pet meals and pet grooming services, for example, are becoming increasingly popular among pet owners.

Pet food is one of the most stringently regulated food items; pet animal feeds are examined at every phase, from the materials used in food preparation through product marketing. The high stringency involved with commercialization might be a substantial barrier to market expansion.

In terms of revenue generation, North America was the most profitable area in 2024. Increasing pet humanization and pet ownership, the introduction of private label retail brands, and increased urbanization are some of the key driving forces supporting the expansion of the North American pet food packaging market. In North America, the pet food industry has become extremely competitive. In response to increased demand from pet owners for protective, informative, and ecological packaging, manufacturers are focusing on creating more intelligent packaging options. However, due to rising animal adoption rates in the region because of growing awareness of animal mistreatment and more humanization, Asia-Pacific is predicted to be the fastest expanding market throughout the projection period. Furthermore, the pet food packaging industry in the region has grown significantly as a result of technical improvement. During the projected period, this is expected to further enhance the market in Asia-Pacific.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 12.03 Billion |

| Revenue forecast in 2034 | USD 24.90 Billion |

| Growth rate CAGR | CAGR of 7.6% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

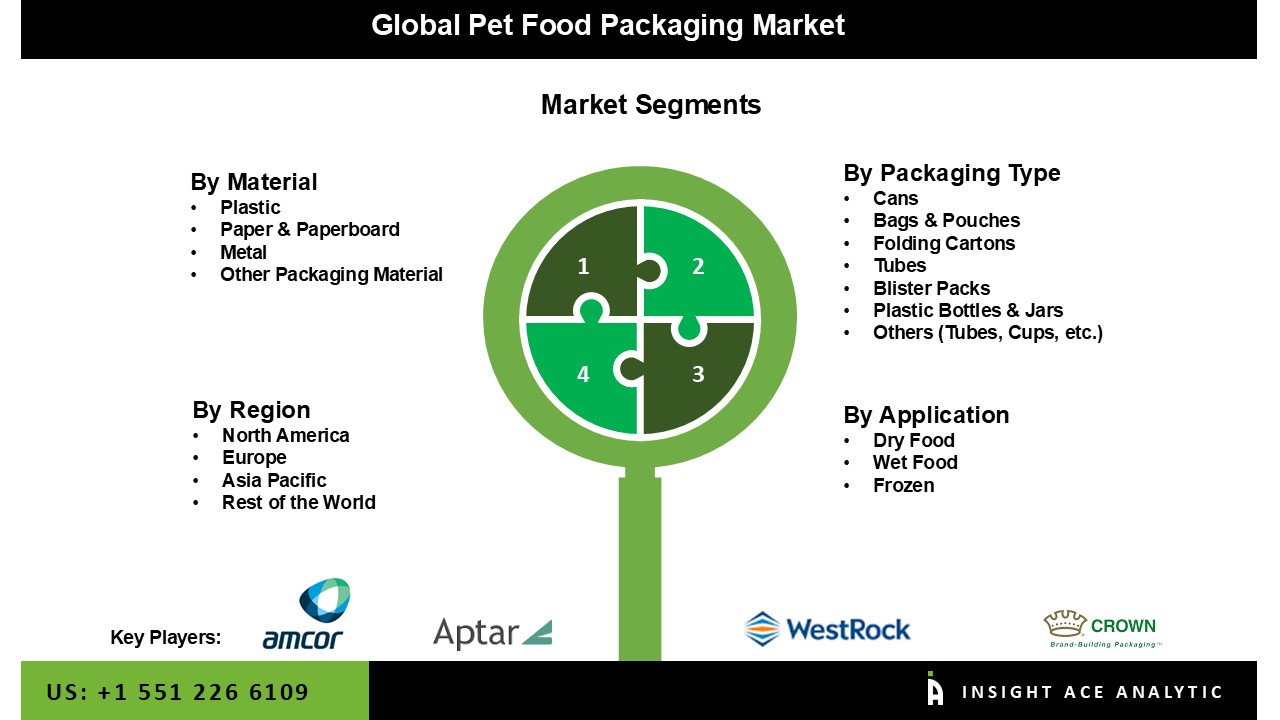

| Segments covered | By Material, Packaging Type, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Amcor Plc, Aptar Group Inc., Ardagh Group S.A., Coveris Holdings S.A., Crown Holdings Inc., Constantia Flexibles Group GmbH, KapStone Paper and Packaging Corporation, Kendall, packaging Corporation, Formell Industries Inc., Mondi Group Plc, ProAmpac LLC, WestRock Company, Sonoco Products Co, Silgan Holdings Inc., TCL Packaging Ltd., NNZ Group, The InterFlex Group Inc., Berry Global Inc |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Material-

By Packaging Type-

By Application-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Pet Food Packaging Market Snapshot

Chapter 4. Global Pet Food Packaging Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Industry Analysis – Porter’s Five Forces Analysis

4.6. Competitive Landscape & Market Share Analysis

4.7. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: By Route of Administration, Estimates & Trend Analysis

5.1. By Material, & Market Share, 2024 & 2034

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Material:

5.2.1. Plastic

5.2.2. Paper & Paperboard

5.2.3. Metal

5.2.4. Other Packaging Material

Chapter 6. Market Segmentation 2: By Application Estimates & Trend Analysis

6.1. By Packaging Type & Market Share, 2024 & 2034

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Packaging Type:

6.2.1. Cans

6.2.2. Bags & Pouches

6.2.3. Folding Cartons

6.2.4. Tubes

6.2.5. Blister Packs

6.2.6. Plastic Bottles & Jars

6.2.7. Others (Tubes, Cups, etc.)

Chapter 7. Market Segmentation 3: By Packaging Type Estimates & Trend Analysis

7.1. By Application & Market Share, 2020& 2030

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following By Application:

7.2.1. Dry Food

7.2.2. Wet Food

7.2.3. Frozen

Chapter 8. Pet Care Packaging Market Segmentation 5: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Pet Food Packaging Market revenue (US$ Million) estimates and forecasts By Material, 2021-2034

8.1.2. North America Pet Food Packaging Market revenue (US$ Million) estimates and forecasts By Packaging Type, 2021-2034

8.1.3. North America Pet Food Packaging Market revenue (US$ Million) estimates and forecasts By Application, 2021-2034

8.1.4. North America Pet Food Packaging Market revenue (US$ Million) estimates and forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Pet Food Packaging Market revenue (US$ Million) By Material, 2021-2034

8.2.2. Europe Pet Food Packaging Market revenue (US$ Million) By Packaging Type, 2021-2034

8.2.3. Europe Pet Food Packaging Market revenue (US$ Million) By Application, 2021-2034

8.2.4. Europe Pet Food Packaging Market revenue (US$ Million) by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Pet Food Packaging Market revenue (US$ Million) By Material, 2021-2034

8.3.2. Asia Pacific Pet Food Packaging Market revenue (US$ Million) By Packaging Type, 2021-2034

8.3.3. Asia Pacific Pet Food Packaging Market revenue (US$ Million) By Application, 2021-2034

8.3.4. Asia Pacific Pet Food Packaging Market revenue (US$ Million) by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Pet Food Packaging Market revenue (US$ Million) By Material, (US$ Million) 2021-2034

8.4.2. Latin America Pet Food Packaging Market revenue (US$ Million) By Packaging Type, (US$ Million) 2021-2034

8.4.3. Latin America Pet Food Packaging Market revenue (US$ Million) By Application, (US$ Million) 2021-2034

8.4.4. Latin America Pet Food Packaging Market revenue (US$ Million) by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Pet Food Packaging Market revenue (US$ Million) By Material, (US$ Million) 2021-2034

8.5.2. Middle East & Africa Pet Food Packaging Market revenue (US$ Million) By Packaging Type, (US$ Million) 2021-2034

8.5.3. Middle East & Africa Pet Food Packaging Market revenue (US$ Million) By Application, (US$ Million) 2021-2034

8.5.4. Middle East & Africa Pet Food Packaging Market revenue (US$ Million) by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Amcor Plc

9.2.2. Aptar Group Inc.

9.2.3. Ardagh Group S.A.

9.2.4. Coveris Holdings S.A.

9.2.5. Crown Holdings Inc.

9.2.6. Constantia Flexibles Group GmbH

9.2.7. KapStone Paper and Packaging Corporation

9.2.8. Kendall packaging Corporation

9.2.9. Formell Industries Inc.

9.2.10. Mondi Group Plc

9.2.11. ProAmpac LLC

9.2.12. WestRock Company

9.2.13. Sonoco Products Co

9.2.14. Silgan Holdings Inc.

9.2.15. TCL Packaging Ltd.

9.2.16. NNZ Group

9.2.17. The InterFlex Group Inc.

9.2.18. Berry Global Inc.

9.2.19. Other Prominent Players