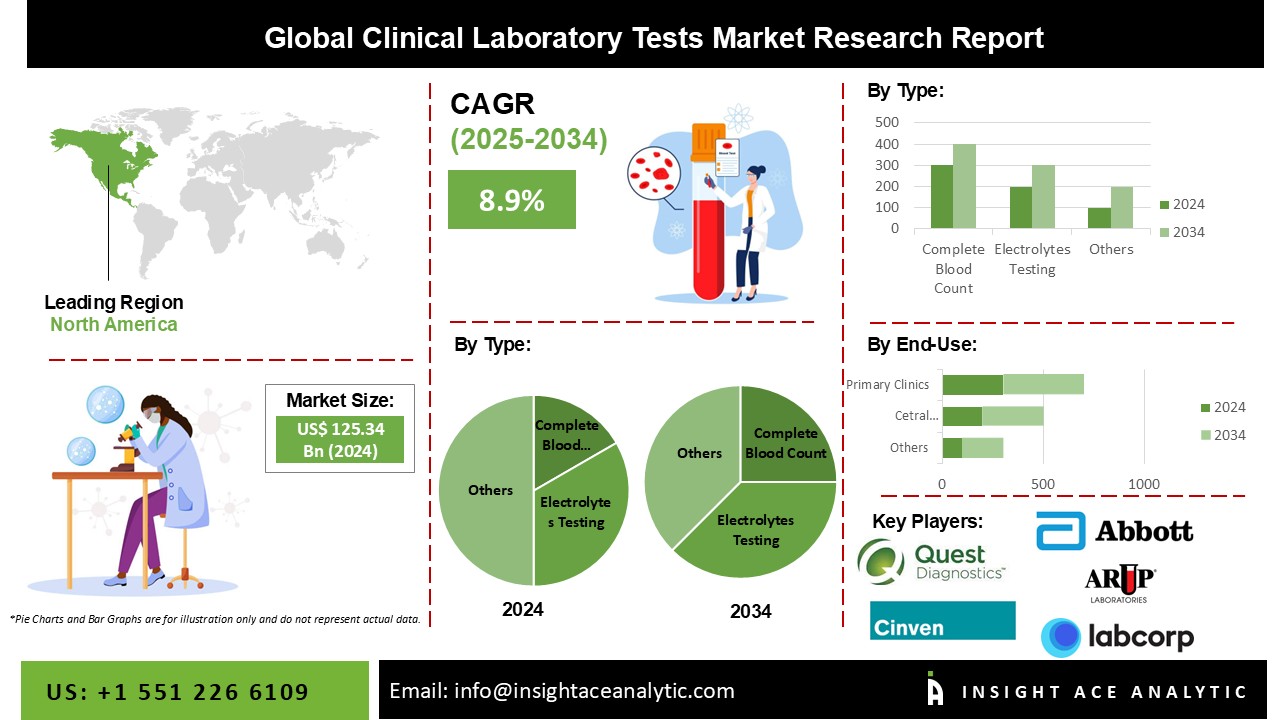

Clinical Laboratory Tests Market Size is valued at USD 125.34 billion in 2024 and is predicted to reach USD 291.98 billion by the year 2034 at an 8.9% CAGR during the forecast period for 2025-2034.

The market for clinical laboratory tests is expanding due to factors like an aging population, an expansion in the prevalence of target diseases, and the development of creative solutions to suit the market's increased need for clinical testing. The spread of COVID-19 has significantly impacted the healthcare and testing industries.

The pandemic's negative consequences have been seen in the market for clinical laboratory tests. For instance, LabCorp saw an 8.9% decrease in total sales in 2020. This is also because fewer people underwent routine medical examinations during the pandemic, which decreased the number of clinical chemistry tests performed. However, the frequency of tests has returned to normal, suggesting that the COVID-19 epidemic has no impact in the long term.

The WHO reports that in most industrialized economies, the average life expectancy has surpassed 80 years. Aging is a significant risk factor for the emergence of infectious diseases due to the interaction of various environmental and genetic factors that impact immunity and metabolism, changing the function of organs. Hence, diagnostics and screening might be crucial in treating general health. Therefore, as the elderly population grows, so does the demand for acute and long-term healthcare, fueling the expansion of the global market.

The Clinical Laboratory Tests market is segmented based on type and end-use. Based on type, the market is segmented as Complete Blood Count, HGB/ HCT testing, Basic Metabolic Panel Testing, BUN Creatinine Testing, Electrolytes Testing, HbA1c Testing, Comprehensive Metabolic Panel Testing, Liver Panel Testing (Hepatitis, Bile Duct Obstruction, Liver Cirrhosis, Liver Cancer, Bone Disease, Autoimmune Disorders, Others) Renal Panel Testing, Lipid Panel Testing, and Cardiovascular Panel Testing. By end-use, the market is segmented into Central Laboratories, and Primary Clinics.

The segment for HbA1c tests held the largest market share. Although patients with fluctuating levels of HbA1c run a higher risk of developing problems from diabetes, it is projected that the growing number of patients with diabetes and aberrant cholesterol levels will fuel market expansion. Furthermore, the introduction of more recent laboratory testing is anticipated to further fuel market expansion. For instance, OmegaQuant introduced the HbA1c Test in May 2022 to measure the level of blood sugar in the body. A home collection device for diabetes risk testing called LabCorp on demand was also introduced by LabCorp in May 2022. Such fresh launches provide accessibility to a variety of lab tests for determining blood sugar levels.

Over the projected period, the central laboratories sector is anticipated to extend at the fastest rate. The intense market penetration and procedure volumes are credited with the segment's growth. Another significant factor projected to propel the market is the rising number of efforts undertaken by governments to provide various services, such as reimbursement for clinical laboratory testing. For the integration of many tests, including microbiology testing, several healthcare organizations are collaborating with laboratories. Furthermore, a sizable portion comes from a huge number of laboratories in developing and emerging countries. Regulatory agencies are also enhancing laboratory services and simplifying the diagnosing process.

The region with the biggest market share is anticipated to hold onto that position during the projection period. This might be linked to the region's growing senior population, increased chronic illness prevalence, including cancer, and intense market penetration of cutting-edge diagnostic techniques. One of the substantial causes of death in North America, according to the American Cancer Society, is cancer. Prostate cancer in males and breast cancer in women are the two most frequently diagnosed cancers. The regional market is anticipated to be driven by factors like rising patient awareness and a growing inclination for novel techniques.

|

Report Attribute |

Specifications |

|

Market size value in 2024 |

USD 125.34 Bn |

|

Revenue forecast in 2034 |

USD 291.98 Bn |

|

Growth rate CAGR |

CAGR of 8.9% from 2025 to 2034 |

|

Quantitative units |

Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report coverage |

The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments covered |

By Type And End-Use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

|

Competitive Landscape |

Quest Diagnostics Incorporated.; Abbott; Cinven; Laboratory Corporation of America Holdings; ARUP Laboratories; OPKO Health, Inc.; UNILABS; Clinical Reference Laboratory, Inc.; Synnovis Group LLP; Sonic Healthcare Limited. |

|

Customization scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and available payment methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Clinical Laboratory Tests Market Snapshot

Chapter 4. Global Clinical Laboratory Tests Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Product Type Estimates & Trend Analysis

5.1. by Product Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Product Type:

5.2.1. Complete Blood Count

5.2.2. HGB/ HCT Testing

5.2.3. Basic Metabolic Panel Testing

5.2.4. BUN Creatinine Testing

5.2.5. Electrolytes Testing

5.2.6. HbA1c Testing

5.2.7. Comprehensive Metabolic Panel Testing

5.2.8. Liver Panel Testing

5.2.8.1. Hepatitis

5.2.8.2. Bile Duct Obstruction

5.2.8.3. Liver Cirrhosis

5.2.8.4. Liver Cancer

5.2.8.5. Bone Disease

5.2.8.6. Autoimmune Disorders

5.2.8.7. Others

5.2.9. Renal Panel Testing

5.2.10. Lipid Panel Testing

5.2.11. Cardiovascular Panel Tests

Chapter 6. Market Segmentation 2: by End-Use Estimates & Trend Analysis

6.1. by End-Use & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End-Use:

6.2.1. Central Laboratories

6.2.1.1. Complete Blood Count

6.2.1.2. HGB/ HCT testing

6.2.1.3. Basic Metabolic Panel Testing

6.2.1.4. BUN Creatinine Testing

6.2.1.5. Electrolytes Testing

6.2.1.6. HbA1c Testing

6.2.1.7. Comprehensive Metabolic Panel Testing

6.2.1.8. Liver Panel Testing

6.2.1.9. Renal Panel Testing

6.2.1.10. Lipid Panel Testing

6.2.1.11. Cardiovascular Panel Tests

6.2.2. Primary Clinics

6.2.2.1. Complete Blood Count

6.2.2.2. HGB/ HCT testing

6.2.2.3. Basic Metabolic Panel Testing

6.2.2.4. BUN Creatinine Testing

6.2.2.5. Electrolytes Testing

6.2.2.6. HbA1c Testing

6.2.2.7. Comprehensive Metabolic Panel Testing

6.2.2.8. Liver Panel Testing

6.2.2.9. Renal Panel Testing

6.2.2.10. Lipid Panel Testing

6.2.2.11. Cardiovascular Panel Tests

Chapter 7. Clinical Laboratory Tests Market Segmentation 3: Regional Estimates & Trend Analysis

7.1. North America

7.1.1. North America Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.1.2. North America Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

7.1.3. North America Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.2. Europe

7.2.1. Europe Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.2.2. Europe Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

7.2.3. Europe Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.3. Asia Pacific

7.3.1. Asia Pacific Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.3.2. Asia Pacific Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

7.3.3. Asia Pacific Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.4. Latin America

7.4.1. Latin America Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.4.2. Latin America Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

7.4.3. Latin America Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.5. Middle East & Africa

7.5.1. Middle East & Africa Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.5.2. Middle East & Africa Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

7.5.3. Middle East & Africa Clinical Laboratory Tests Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 8. Competitive Landscape

8.1. Major Mergers and Acquisitions/Strategic Alliances

8.2. Company Profiles

8.2.1. Abbott

8.2.2. ARUP Laboratories;

8.2.3. Bioscientia Healthcare GmbH (Germany)

8.2.4. Charles River Laboratories (U.S.)

8.2.5. Cinven;

8.2.6. Clinical Reference Laboratory, Inc.;

8.2.7. Fresenius Medical Care AG & Co. KGaA (Germany)

8.2.8. Genoptix, Inc. (U.S.)

8.2.9. Healthscope (Australia)

8.2.10. Laboratory Corporation of America Holdings;

8.2.11. Merck KGaA (Germany)

8.2.12. NeoGenomics Laboratories (U.S.)

8.2.13. OPKO Health, Inc.;

8.2.14. QIAGEN (Germany)

8.2.15. Quest Diagnostics Incorporated.;

8.2.16. Siemens Healthcare Private Limited (Germany)

8.2.17. Sonic Healthcare Limited

8.2.18. Synnovis Group LLP;

8.2.19. The Laboratory Glassware Co. (U.S.)

8.2.20. Tulip Diagnostics (P) Ltd. (India)

8.2.21. UNILABS;

8.2.22. Other Prominent Players

Clinical Laboratory Tests Market By Type-

Clinical Laboratory Tests Market By End-Use-

Clinical Laboratory Tests Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

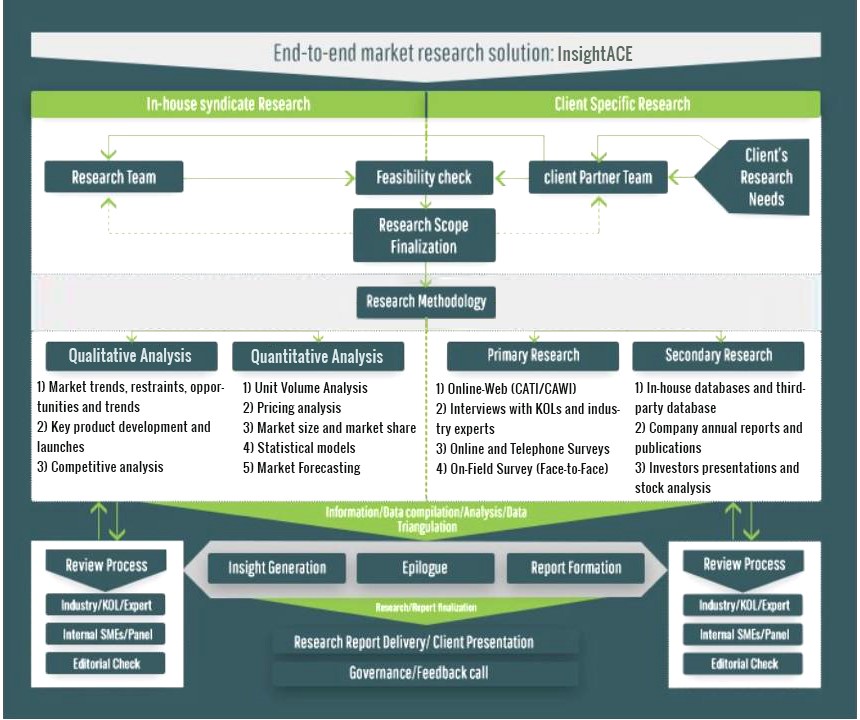

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.