Global AI-Powered Agri-Insurance Risk Modelling Market Size is valued at US$ 2.1 Bn in 2024 and is predicted to reach US$ 19.4 Bn by the year 2034 at an 25.2% CAGR during the forecast period for 2025-2034.

AI-powered agri-insurance risk modeling uses machine learning, satellite data, IoT sensors, and climate analytics to assess and predict farming risks (droughts, floods, pests, yield losses). These models help insurers price policies accurately, automate claims, and reduce fraud by analyzing real-time field data. The growing use of real-time data integration from satellite imaging, climate monitoring systems, and loT sensors is driving the need for Al-powered agri-insurance risk modelling. The use of dynamic pricing algorithms by insurers that adjust to environmental conditions has given farmers flexible protection. The Al-powered agri-insurance risk modelling market will expand as a result of this.

Furthermore, parametric insurance supported by Al is gaining popularity as a way to guarantee quick, data-driven payouts in the event of floods, droughts, and other emergencies. With the expansion of digital policy delivery channels, particularly through mobile platforms in remote farming regions, this change enables insurers to decrease claim disputes and enhance customer satisfaction. Nonetheless, the Al-powered agri-insurance risk modelling market has certain difficulties. While farmers' lack of knowledge about available products limits market expansion, regulatory barriers can impede the adoption of innovative insurance schemes.

Some of the Key Players in AI-Powered Agri-Insurance Risk Modelling Market are:

The ai-powered agri-insurance risk modelling market is segmented by component, type, deployment mode, application, technology, farm size, and end-use. The component segment comprises services, software, and platforms. By type, the market is segmented into probabilistic risk modelling, parametric risk modelling, deterministic modelling, deep learning forecast models, ensemble modelling solutions, and machine learning-based simulation models. As per the deployment mode, the market is segmented into cloud-based and on-premise. Based on the application, segment consists of crop insurance, greenhouse insurance, aquaculture insurance, forestry insurance, and livestock insurance. By technology, the market is segmented into predictive analytics, machine learning (ML), artificial intelligence (AI), remote sensing, natural language processing (NLP), and geographic information systems (GIS). As per the farm size, the market is segmented into small farms, medium farms, and large farms. By end-use, the market is segmented into agri-tech firms, insurance companies, financial institutions, farmers & producer organizations, government agencies, and reinsurance companies.

In 2024, the parametric risk modelling category dominated the Al-powered agri-insurance risk modelling market because it provided quicker claim settlements based on quantifiable factors like wind speed, temperature, or rainfall. Because of their efficiency and openness, insurers favor these models, particularly in areas that are regularly affected by climatic fluctuations. Increasingly, governments and insurers work together to extend parametric products in regions that are vulnerable to floods and drought, strengthening the financial resilience of rural communities. Furthermore, the adoption in emerging economies is strengthened by the ease of use of payments and weather station integration.

In order to improve underwriting, increase operational effectiveness, and provide new insurance products, insurance companies continue to be the principal consumers of Al models. These companies use modelling tools to automate processes and shorten response times by integrating them with basic insurance systems. Businesses spend on Al when the competition heats up in order to differentiate their products and improve client satisfaction. The agri-tech companies, on the other hand, integrate Al models into their service platforms as innovation partners. By converting unprocessed farm data into risk insights, these companies help insurers and farmers communicate.

The market for Al-powered agri-insurance risk modelling was dominated by North America because of its robust regulatory support and high level of digital infrastructure. Insurers are using AI in the US and Canada more and more to support precision farming insurance, automate claims, and improve climate risk modelling. These areas are at the forefront of combining machine learning, remote sensing, and satellite analytics to evaluate agricultural damage and livestock health.

The Europe region is predicted to grow rapidly in the market due to rising climate unpredictability and a push for agricultural resilience. In this region, governments and non-governmental organizations also back Al-powered models to enhance disaster aid and subsidy targeting and reduce claim delays. Additionally, as mobile connectivity and digital literacy advance, insurers use Al-driven platforms that are customized to local farming systems and risk profiles to reach a wider audience, promoting inclusive and scalable growth.

|

Report Attribute |

Specifications |

|

Market Size Value In 2024 |

USD 2.1 Bn |

|

Revenue Forecast In 2034 |

USD 19.4 Bn |

|

Growth Rate CAGR |

CAGR of 25.2% from 2025 to 2034 |

|

Quantitative Units |

Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Component, By Type, By Deployment Mode, By Application, By Technology, By Farm Size, By End-use, and By Region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

|

Competitive Landscape |

IBM (Agri-focused Al Insurance Solutions), Swiss Re, Generali, Aon plc, Bayer's Climate Corp, Indigo Ag, AgroGuard, AgRisk Analytics, AgriShield, Lemonade (Agri-Insurance Al), Munich Re, AXA XL, Allianz, John Deere (Precision Agri-Insurance), Taranis, Descartes Labs (Agri-Risk Al), Syngenta (Al Risk Modelling), Swiss Re's Digital Ecosystem Partners, Blue River Technology (Al for Agri-Risk), and Munich Re's Al Agri-Insurance Ventures |

|

Customization Scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

|

Pricing and Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of AI-Powered Agri-Insurance Risk Modelling Market -

AI-Powered Agri-Insurance Risk Modelling Market by Component-

AI-Powered Agri-Insurance Risk Modelling Market by Type -

AI-Powered Agri-Insurance Risk Modelling Market by Deployment Mode-

AI-Powered Agri-Insurance Risk Modelling Market by Application-

AI-Powered Agri-Insurance Risk Modelling Market by Technology-

AI-Powered Agri-Insurance Risk Modelling Market by Farm Size-

AI-Powered Agri-Insurance Risk Modelling Market by End-user-

AI-Powered Agri-Insurance Risk Modelling Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

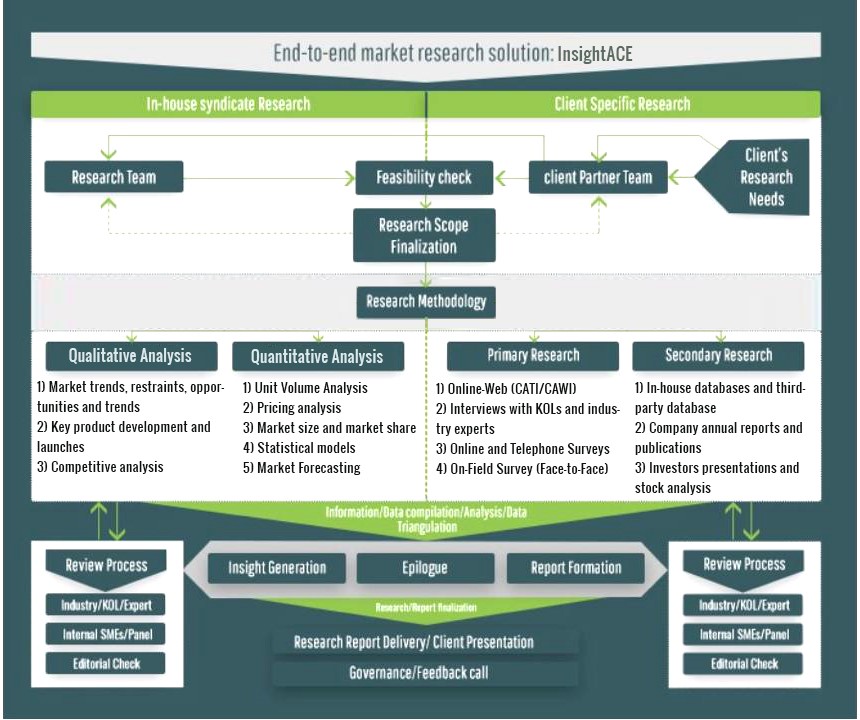

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.