The Plant-based Protein Market Size is valued at 13.33 Billion in 2022 and is predicted to reach 25.94 Billion by the year 2031 at an 8.2 % CAGR during the forecast period for 2023-2031.

Protein is a vital nutrient used for maintaining muscles and bones, as well as supporting the immune system, among other things. Plant-based diets offer a diversity of health benefits, including healthy weight, optimal health, and longevity. The amino acids within the protein are used to build and repair tissues necessary for infants and children's normal growth and development. Plant-based dietary patterns feature a widespread range of dietary regimens that are predominantly based on plant foods. Plant-based protein sources include soy, wheat, Pea, and other plant sources. Plant protein is low in saturated fat and cholesterol and is a good source of unsaturated fat, fibers, vitamins, and minerals.

At present times, people have started to pay more attention to their diet and health since the coronavirus outbreak. The Plant-Based Foods Association (PBFA) accounted for all plant-based sales during the third week of March, the beginning of most shutdowns in the U.S., was up 90% compared with the previous year, and still 27% higher a month later.

Growing consumption of plant-based food due to naturally occurring fibers, anti-inflammatory micronutrients, antioxidants, lower calorie counts, and increasing demand for high-protein content products are mainly driving the market growth. The rising consumer awareness about the health benefits of plant-based foods is further accelerating the market's growth. Growing demand for fat-free and low-fat protein sources along with an emerging shift towards food patterns to a more plant-based diet, is anticipated to show significant growth during the forecast period.

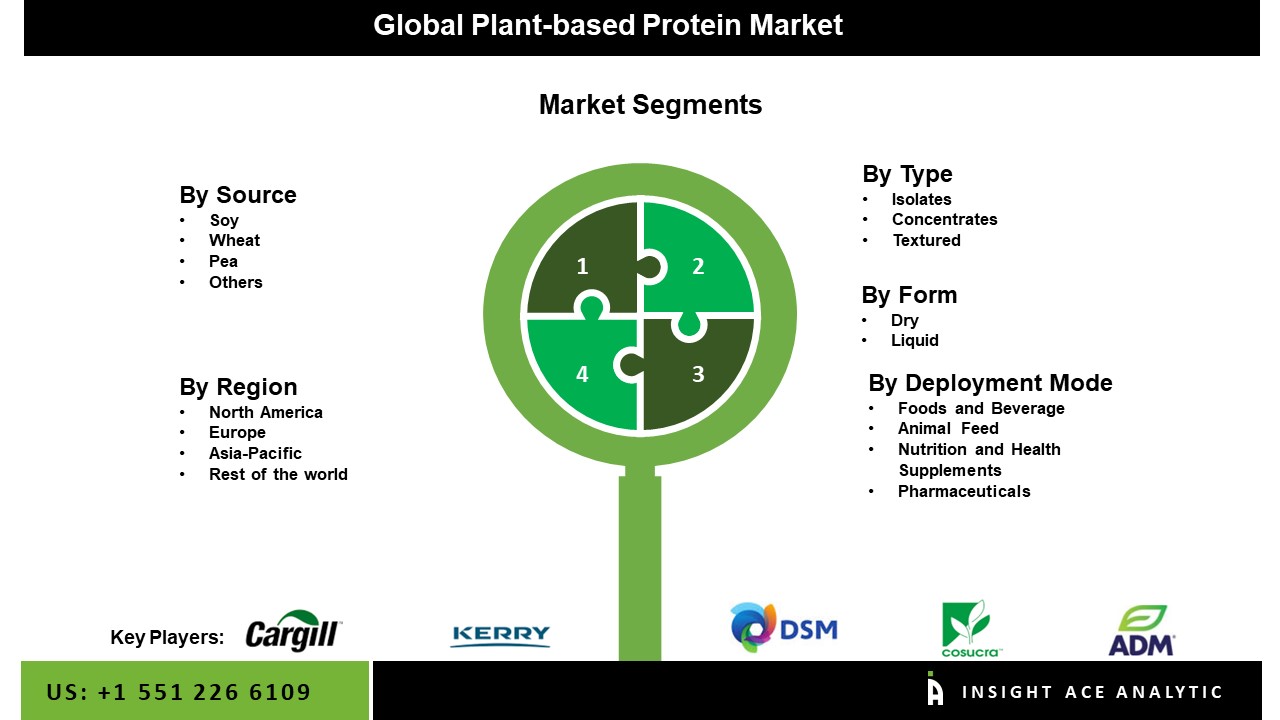

Market Segmentation

The Global Plant-based Protein market is categorized on the basis of Source, Type, Form and Application, and region. On the basis of Source, the market is segmented into Soy, Wheat, Pea, and Others. On the basis of Type, the market is segmented into Isolates, Concentrates, and Textured. Based on Form, the market is categorized into Dry and Liquid. Based on Application, the market is categorized into Foods and Beverage, Animal Feed, Nutrition and Health Supplements, and Pharmaceuticals. Based on region, the market is studied across North America, Asia-Pacific, Europe, and LAMEA. On the other hand, Asia-Pacific is expected to dominate the market during the analysis of the forecast period.

Competitive Landscape

Some Major Key Players In The Plant-based Protein Market:

- Archer Daniels Midland Company ,

- DSM,

- E.I. Dupont De Nemours and Company ,

- Kerry Group ,

- Cargill Inc.,

- Glanbia plc.,

- Wilmar International ,

- Emsland Group ,

- Puris ,

- Cosucra Group,

- AMCO Proteins Company ,

- Batory Foods ,

- Roquette Freres ,

- Ingredion Inc.,

- Burcon Nutracience ,

- Sotexpro,

- AGT Food & Ingredients ,

- Beneo ,

- Prolupin Gmbh ,

- Aminola ,

- Herblink Biotech Corporation ,

- ET Chem ,

- Shandong Jianyuan Group ,

- The Greenlans LLC ,

- Parabel ,

- Corbion NV,

- Danone,

- Farbest Brands,

- Axiom Foods Inc.

- NOW Foods ,

- Tate & Lyle Plc,

- Crespel & Deiters GmbH & Co. KG,

- CHS Inc.,

Plant-based Protein Market Report Scope

|

Report Attribute |

Specifications |

|

Market Size Value In 2023 |

USD 13.81 Billion |

|

Revenue Forecast In 2031 |

USD 25.94 Billion |

|

Growth Rate CAGR |

CAGR of 8.8 % from 2024 to 2031 |

|

Quantitative Units |

Representation of revenue in US$ Billion and CAGR from 2024 to 2031 |

|

Historic Year |

2019 to 2023 |

|

Forecast Year |

2024-2031 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Source, By Type, By Form, By Deployment Mode |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

|

Competitive Landscape |

Archer Daniels Midland Company , DSM, E.I. Dupont De Nemours and Company , Kerry Group , Cargill Inc., Glanbia plc., Wilmar International , Emsland Group , Puris , Cosucra Group, AMCO Proteins Company , Batory Foods , Roquette Freres , Ingredion Inc., Burcon Nutracience , Sotexpro, AGT Food & Ingredients , Beneo , Prolupin Gmbh , Aminola , Herblink Biotech Corporation , ET Chem , Shandong Jianyuan Group , The Greenlans LLC , Parabel , Corbion NV, Danone, Farbest Brands, Axiom Foods Inc. , NOW Foods , Tate & Lyle Plc, Crespel & Deiters GmbH & Co. KG, CHS Inc., and Other Prominent Players |

|

Customization Scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |