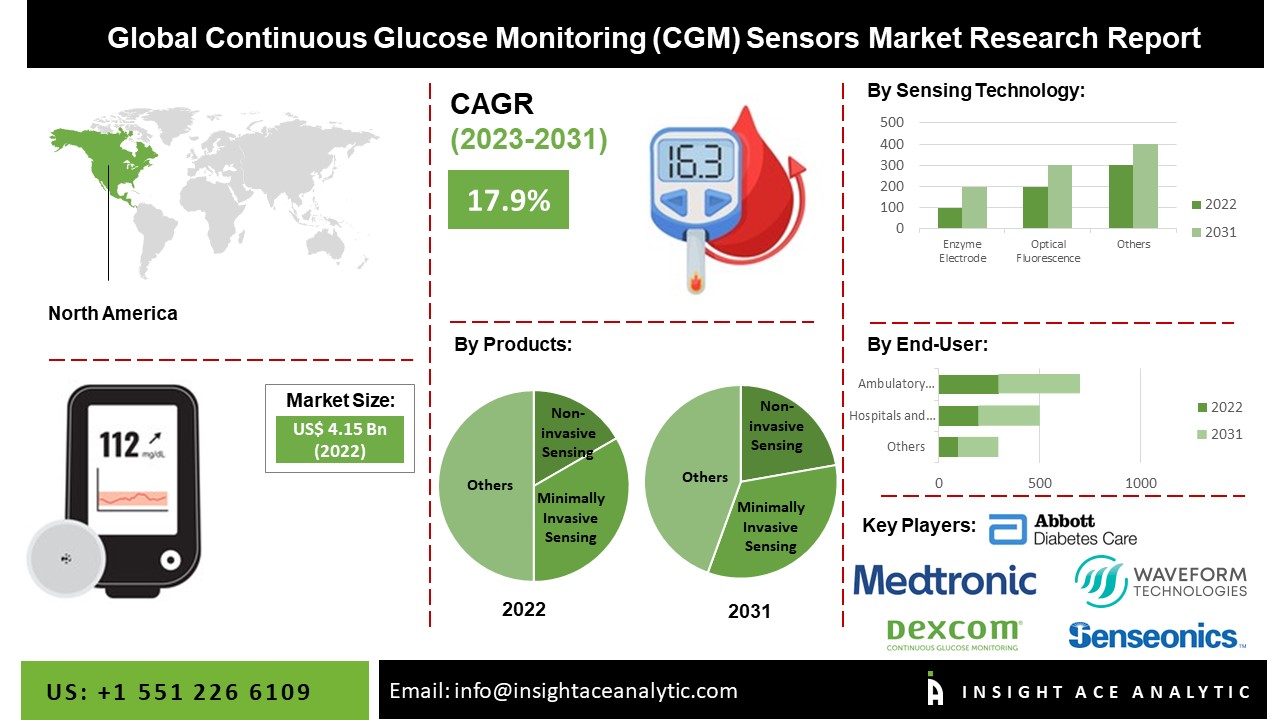

The Continuous Glucose Monitoring (CGM) Sensors Market Size is valued at 4.15 Billion in 2022 and is predicted to reach 17.98 Billion by the year 2031 at a 17.9 % CAGR during the forecast period for 2023-2031.

Diabetes technology has progressed remarkably over the past few years, including the development of markers for diabetes control, sophisticated monitoring techniques, mathematical models, assessment procedures, and control algorithms. Continuous glucose monitoring (CGM) sensors provide an effective approach in diabetes management as it checks glucose levels in real-time, displays the change in glucose levels. It also can be used as a tool to predict impending glucose excursions and to assess glycaemic variability. The clinical use of CGM also lowers the risk of mild to moderate hypoglycemia and eradicates the risk of severe and prolonged hypoglycemia.

These devices can be segregated as totally invasive, minimally invasive, and noninvasive based on the nature of their operation. Currently, automation of glucose monitoring is anticipated to save significant nursing time while improving glucose control and safety.

The Global Continuous Glucose Monitoring (CGM) Sensors market is expected to be driven mainly by the growing prevalence of Type 1 and Type 2 diabetes along with the growing geriatric population over the forecast period.

Furthermore, rapidly shifting consumer predilections toward an effective approach to manage diabetes, robust adoption of advanced diabetes management solutions in developing regions, favorable government policies, and rising healthcare spending over time across the globe, growing health awareness, increasing medical tourism, and easy affordability are key factors that are projected to further aid the market growth during the forecast period.

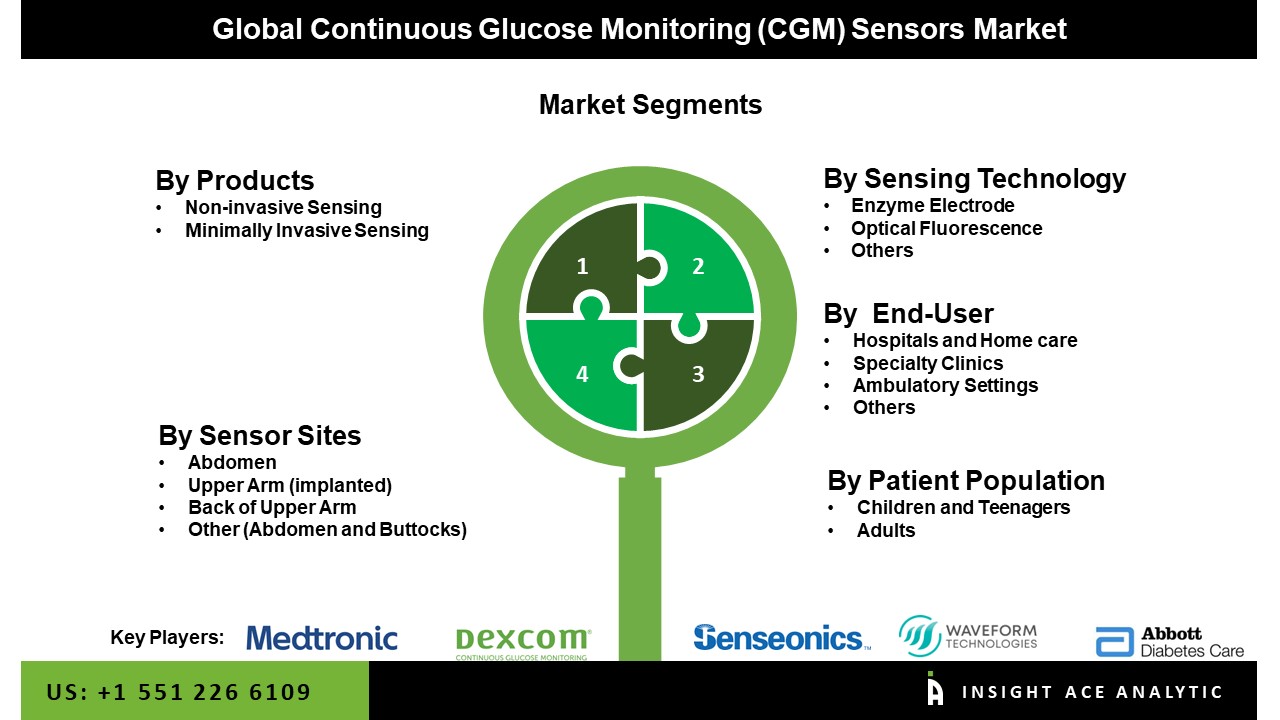

The Global Continuous Glucose Monitoring (CGM) Sensors Market is categorized on the basis of products, sensing technology, end-users, patient population, sites, and region.

Market Segmentation

On the basis of products, the market is segmented into non-invasive sensing and minimally invasive sensing. Based on sensing technology, the market is segmented into enzyme electrode, optical fluorescence, and others. On the basis of end-users, the market is segregated into hospitals and home care, specialty clinics, ambulatory settings, and others. On the basis of patient population, the market is segmented into children & teenagers, and adults. Based on sensor sites, the market is categorized into abdomen, upper arm (implanted), back of upper arm, and other (abdomen and buttocks). Based on the region, the market is studied across North America, Asia-Pacific, Europe, and LAMEA. Among all, North America is expected to dominate the market during the analysis of the forecast period.

Competitive Landscape

Some Of The Key Players In The Continuous Glucose Monitoring (CGM) Sensors Market:

- Medtronics,

- Dexcom,

- Senseonics,

- WaveForm Technologies, Inc.,

- Abbott Diabetes Care Inc,

- Arkal Medical, Inc.,

- Ascensia Diabetes Care Holdings AG,

- Biorasis Inc,

- Debiotech SA,

- DirectSens GmbH,

- Echo Therapeutics Inc,

- EyeSense GmbH,

- Flowsion A/S,

- GlucoSet AS,

- Glucovation Inc,

- Glusense Ltd,

- GlySens Inc,

- iGlyko, Inc.,

- Indigo Diabetes NV,

- Insulet Corp,

- Integrated Medical Sensors,

- Integrity Applications Ltd,

- I-Sens Inc,

- Metronom Health Inc,

- Nemaura Medical Inc,

- PKvitality,

- Prediktor Medical AS,

- Profusa Inc,

- San Meditech (Huzhou) Co., Ltd.,

- Senzime AB,

- Socrates Health Solutions, Inc.,

- other prominent players

The Continuous Glucose Monitoring (CGM) Sensors Market Report Scope

|

Report Attribute |

Specifications |

|

Market Size Value In 2022 |

USD 4.15 Billion |

|

Revenue Forecast In 2031 |

USD 17.98 Billion |

|

Growth Rate CAGR |

CAGR of 17.9 % from 2023 to 2031 |

|

Quantitative Units |

Representation of revenue in US$ Billion and CAGR from 2023 to 2031 |

|

Historic Year |

2019 to 2022 |

|

Forecast Year |

2023-2031 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Product, By Sensing Technology, By End-Users, By Patient Population, By Sensor Sites |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

|

Competitive Landscape |

Medtronics, Dexcom, Senseonics, WaveForm Technologies, Inc., Abbott Diabetes Care Inc, Arkal Medical, Inc., Ascensia Diabetes Care Holdings AG, Biorasis Inc, Debiotech SA, DirectSens GmbH, Echo Therapeutics Inc, EyeSense GmbH, Flowsion A/S, GlucoSet AS, Glucovation Inc, Glusense Ltd, GlySens Inc, iGlyko, Inc., Indigo Diabetes NV, Insulet Corp, Integrated Medical Sensors, Integrity Applications Ltd, I-Sens Inc, Metronom Health Inc, Nemaura Medical Inc, PKvitality, Prediktor Medical AS, Profusa Inc, San Meditech (Huzhou) Co., Ltd., Senzime AB, Socrates Health Solutions, Inc., and other prominent players. |

|

Customization Scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

_Sensors_Market_1.jpg)

Global Continuous Glucose Monitoring (CGM) Sensors Market By Sensing Technology

Global Continuous Glucose Monitoring (CGM) Sensors Market By Sensing Technology